The strange death of corporate Britain

UK stock market performance is awful. Does it matter? It's time to take The Sniff Test.

Non-Emerging Markets

Emerging markets don’t emerge, attention just shifts elsewhere. At the beginning of the 20th Century there was excitement about the potential of America, Argentina, Brazil and South Africa. Only one made it. Argentina in particular has become a text book study of how bad politics destroys national aspirations.

A consequence of this is that smaller nations, in terms of land mass and population, maintain a seat at the high table. Britain and France are prime examples, with permanent seats on the United Nations Security Council. Local media bemoans the lost international influence, but the rest of the world looks on in envy.

The decline of the UK stock market is a recurring media topic. The FTSE 100, which monitors the performance of the largest public companies in the UK, has been one of the world’s worst performing share price indices. This is wonderful news for those who want to claim Britain is failing. In reality, the decline is relative and reflects the fact that emerging markets are finally emerging.

Even if you don’t read the financial pages, you may know that Chancellor Hunt proposed a £5,000 British ISA. For the few people using their £20,000 allowance, there may be a further tax break for investing in the UK. The impact will be minimal but the timing may be fortuitous, as the UK has reached its level.

A pound is not worth a pound

A 20-year career telling professionals what companies were worth, convinced me there is no right value for shares. When asked for a valuation I’d reply “When and relative to what”. Most investors have a benchmark, but few want to define a timeline. Those that did were looking at a matter of days. Over such a short time the safest answer is to assume the current trend continues. Sometimes it does, sometimes it doesn’t.

I had a friend who was an analyst in Singapore. At the end of one morning call, he asked if anyone was interested in a property company he’d spent days writing about. “Make it brief” came the reply from the Head of Hong Kong sales. “$2.42” was his answer.

The joke was on the industry. Vast sums are spent duplicating analysis of shares. Investors only want those that will rise in price the most. This encourages analysts to be optimistic. My friend nailed the brief with a single number.

In financial markets, money is a means of keeping score. The game never ends and hence there is no result. A dollar in one company is worth more than another. Why doesn’t matter, but why other people think it does, matters a lot. This is how the game is played.

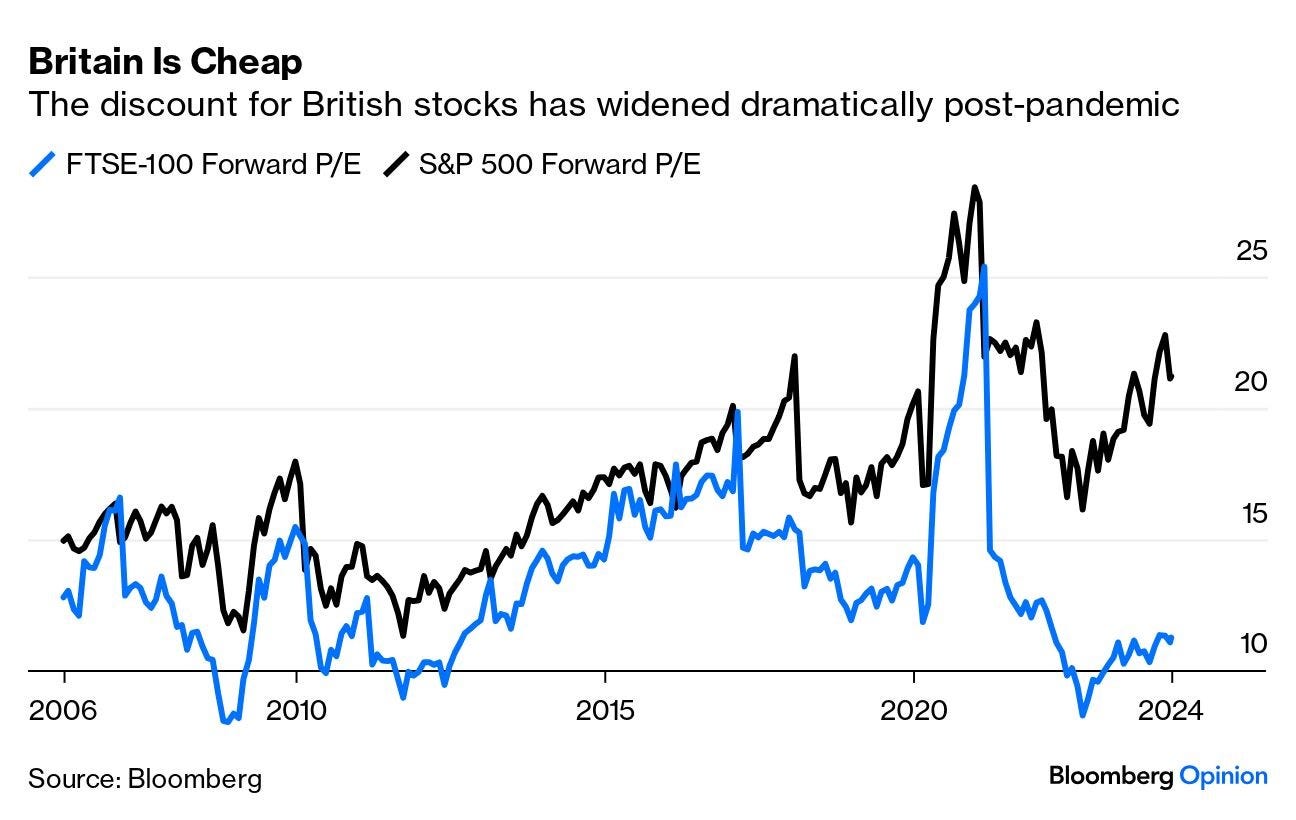

Money in the UK stock market is valued at a lower level than money invested elsewhere. Especially in the US. One pound does not equal another.

UK pension funds know this and invest in the US, both responding to and exacerbating the trend. If the wind were to change, they’d be back.

Black Holes and Bad Explanations

There are lots of possible reasons for the UK’s underperformance. Before we look at some, it’s worth recapping what makes a good explanation.

A theory stems from conjecture, which only humans can do. If it survives criticism it is tested. If our theory explains the evidence better than others and cannot be easily altered, then it becomes knowledge. This means what we know to the best of our abilities today.

What does it mean for a theory to be easily altered? A light in the sky observed regularly might be a UFO. The more often it’s seen, the more convinced the viewer is of alien life. But as “drone”, “airplane” or “star” could be switched for “UFO”, the alien theory is easily altered. Hence it may be dismissed without testing.

In contrast, while we cannot see inside the sun, we understand nuclear fusion at work there. Hydrogen nuclei in plasma form, combine to create helium and release massive amounts of energy at temperatures of around ten million Celsius.

Switch carbon for hydrogen and the explanation fails. The reaction does not happen at room temperature. While our knowledge of fusion is puny compared what it will be, it’s the best we have.

Two points stand out. Nothing other than humans can come up with new explanations. As we don’t know how we do it, we cannot code it into machines. Hence we cannot create artificial general intelligence (AGI), or a machine capable of doing everything a human can.

Some, including many working in AI, believe knowledge comes from observation. Hence feed all data into a machine and AGI will spontaneously emerge. But we cannot see inside the sun and still know how it works. Ditto black holes and sub atomic particles. Knowledge comes from theories, and theories come before observations.

What has this got to do with the UK stock market? When you hear a theory for why the UK is in decline then ask where it is coming from. Has someone drawn a chart and then a conclusion? Do they have an explanation that is hard to vary? The fact that there are a lot of arguments as to why Britain sucks suggests that they are all easy to vary and likely wrong.

The Decline of Empire

Ardent multi-culturalists tell us Britain is full of Little Englanders yearning for the Empire. I have never met anyone who said they wish we still ruled India.

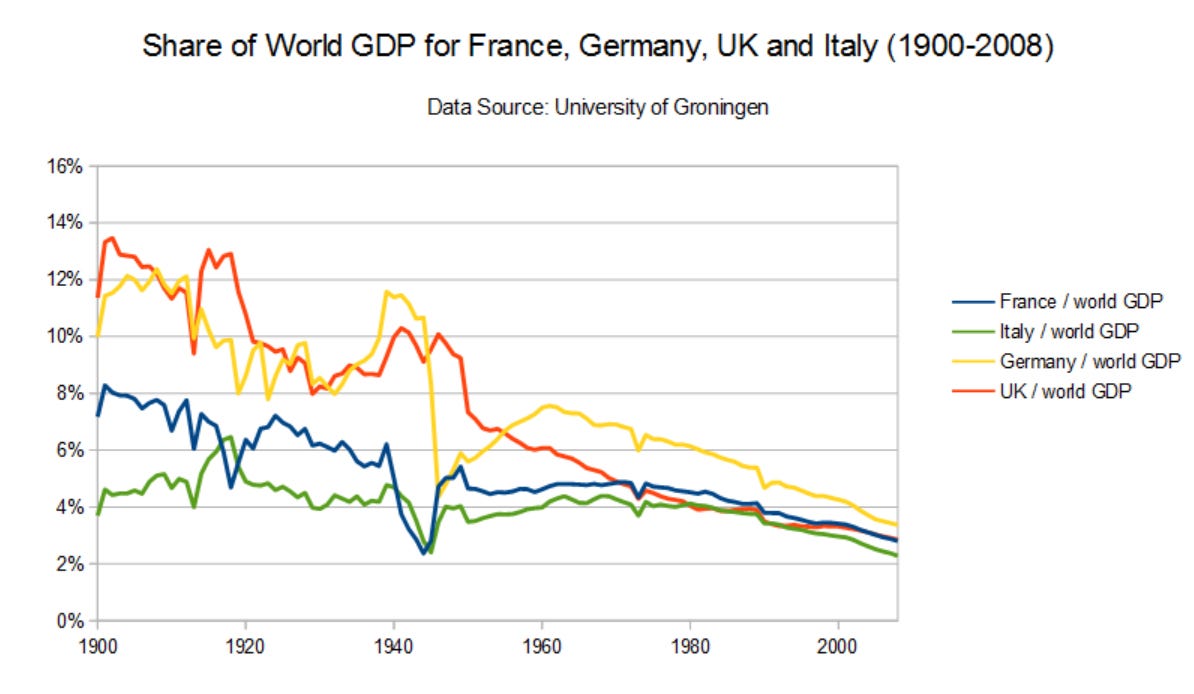

Once you are top dog however, the only way is down. Especially if you are a small country with a limited population. What is remarkable is how outsized the British economy was compared with the rest of the world, rather than its relative position today.

120 years ago the UK and Germany were vying to lead Europe. The US had overtaken both and with untapped land and a booming population would not look back. Germany was devastated by losing World War II, but rebuilt with US money. The relative advantage it gained over the rest of Europe has not been surrendered.

When wars were about empires then going into debt to win was a good strategy. The debt was repaid by land and treasure seized from the vanquished and exploited until the next war. But World Wars I and II were about stopping Germany. Britain lost territory, surrendering its strategic western hemisphere ports in return for US aid.

But while the wars accelerated the decline, they did not cause it, because Britain’s relative economic size topped out around 1900. The decline was due to the rise of the US and hence was relative not absolute. We are a lot richer today than back then. There was another big leg down after China joined the World Trade Organisation in 2001. Both the US and China are a lot bigger than the UK and should have larger economies. Self-flagellation because of this is ridiculous.

Chips and Dollars

In terms of economic history, nothing happened for a long time and then everything happened. Britain led the way

The economic know-how born in the UK spread to other parts of the world. The seed fell on fallow ground in many countries, but a few nurtured and developed it. Trade and transportation were the main vehicles for knowledge transfer. Today it is communication, which is faster and more efficient. Hence there is every reason to believe emerging markets will emerge this time around – it’s easier for knowledge to stick.

The US knows this and is trying to stem China’s access to technology. But China is churning out more sub-10 nanometre chips than should be possible. The theory that the US can stop China progressing is therefore a bad one.

The US also constrains access to the dollar system. China, Russia and others build a workaround. A restrictive policy undermines its own effectiveness in time. This is not to say either nation will match US economic might, but an indication that the peak of US influence will pass.

UK Banks and French Baggage

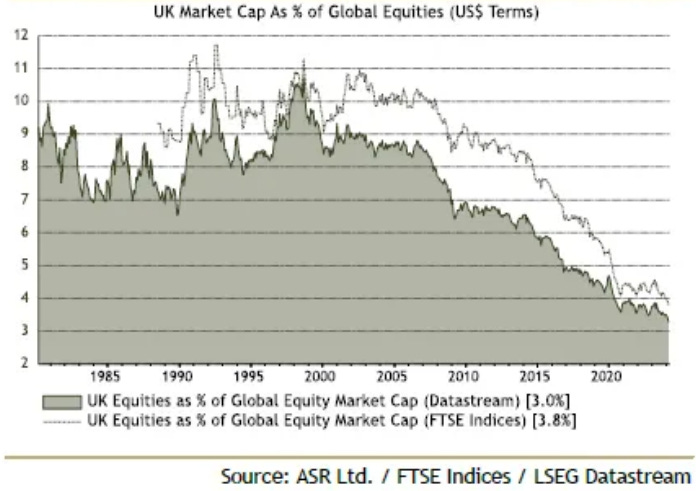

The UK’s share of world GDP and stock markets is about the same. The relative size of the stock market held up longer than that of the economy, because the UK was an attractive place to invest and had a developed pension system. But we didn’t kick on and both foreigners and our own pension funds abandoned ship.

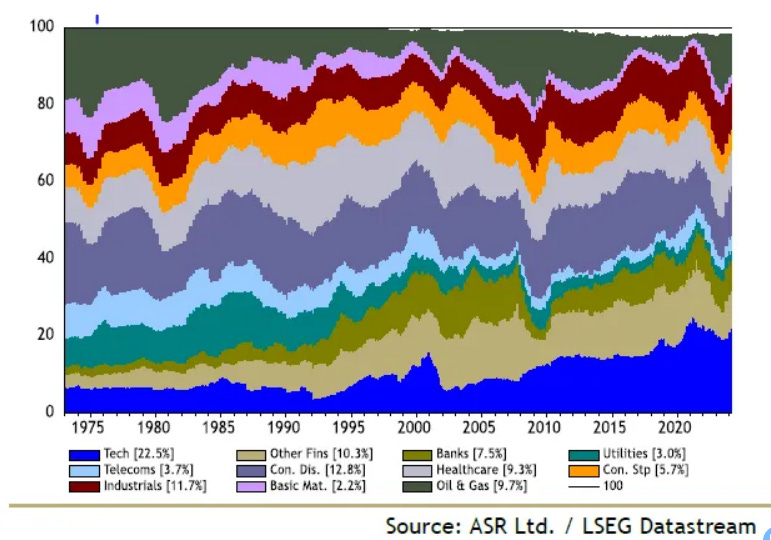

This chart shows the UK’s share of global stock market indices. There are two ways of calculating this, but a figure a little over 3% is commonly used. The UK is 3.2% of global nominal GDP (gross domestic product – a measure of economic size).

Spot the Brexit effect on the chart? No. Well throw out that theory then.

The UK share of global stock markets peaked just before China entered the world economic stage. It took a major dive around the Global Financial Crisis. It’s been heading steadily south since 2014.

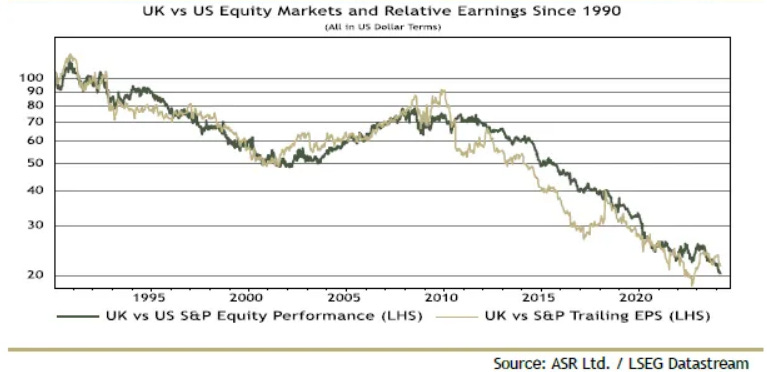

This chart shows how UK and US share prices and company earnings move relative to one another. The downward slope indicates UK prices and earnings doing badly compared to the US. The stock market is simply reflecting the reality that UK companies have done poorly. Why is that?

The largest stocks in the UK are in pharmaceuticals, oil and gas, and banks. The UK has a lot of listed commodity companies that are UK in name only. Commodity prices performed poorly post financial crisis, as did banks.

The French stock market is dominated by luxury goods companies. The world’s rich are getting richer thanks to the money printing after the financial crisis. There are a lot of newly rich people in emerging markets who want LVMH luggage. They no longer bank with HSBC.

The US Exception

The anomaly in the data is not Britain as it returns to its natural level, but the US. It is 25% of the world economy and nearly 50% of its stock markets. The US attracts investment as the world's technology hub.

This is justified by technology companies’ share of US profits of over 20% (EPS is earnings per share, a measure of profits).

The market is not the economy, but it is a reasonable proxy. Over the years, no industry has maintained more than 20% share of profits for long periods.

The explanation is simple and hard to vary. The profits of one industry come from the others. Right now, this is either as companies invest in AI, or consumers do and don’t buy other things. This trend can only continue for so long.

People must buy food, clothing and shelter, but also want other non-techie things. Eventually consumers and companies will have enough gadgets. Firms will either make higher profits from investments in AI, or they won’t and will stop buying it. Either way the relative share of technology company profits will fall.

When Nobody’s Listening

The UK share of the world’s stock markets is broadly in line with its share of the world economy. It’s taken a while to get there. If this is the death of corporate Britain, it’s a strange one, more like a reversion to the mean.

World wars hastened the decline, but the spread of technology through transport and communications was more important in allowing other nations to rise.

Britain will continue to grow more slowly than emerging markets and its relative position reduce. This is cause for celebration, as it means increasing wealth and opportunity for more people around the world. The statistics will, however, be twisted into negative narratives on slow news days.

Being at the heart of technology has maintained the dominant position of the US. Those calling for this to end may finally be right. Predictions of trend reversals are usually most successful when hubris reigns, but this is also when fewest people are listening.