AI and the Dawn of the Automation Age

An epic bubble in AI investing signals capitalism is back and ushering in a new era. It’s time to take The Sniff Test.

All in on AI

“Why did no one see it coming?” the late Queen asked of the financial crisis in 2008. The answer that’s how capitalism works, ma’am, would not have impressed.

Yet this is what Chuck Prince, boss of Citigroup meant when he said “But as long as the music is playing, you’ve got to get up and dance.”

Prince knew what would happen and said as much in the rest of the quote. Yet because he was the head of one of the world’s largest financial organisations, he had to play the game by the rules.

Prince worked for Citigroup’s owners, its shareholders. If Citigroup lagged peers they would dump shares or fire Prince. To align their interests, most of Prince’s pay was in shares. He just said what everyone else did.

A modern day Prince would be all-in on artificial intelligence.

An Obvious Bubble

Stock markets love a metaphor. The market goes up the stairs and down the elevator, meaning rises are slow and falls fast. A panic is shouting “fire” in a crowded theatre. Cycles are both unpredictable and familiar.

It pays to be optimistic. No one gets fired for doing the same as everyone else. A fund manager at Jardine Fleming in Hong Kong told me he didn’t care about the market falling. His job was to outperform when it rose, because that was when most investors piled into funds.

Investing bubbles occur when an asset class or industry attracts the lion’s share of short-term capital. In stock market bubbles the money flows between shareholders, with only a trickle for the companies they invest in. Those bubbles start because of what’s happening in the real economy.

Early stage investment happens outside of the stock market. The private equity and debt markets are accessible to qualified investors. Qualification requires income or assets. The most attractive investments require plenty of both.

At some point these private investments are sold on public markets such as the New York and London Stock Exchange. That’s when ordinary people get access to new technology through their pension schemes. The time taken to list on public markets is getting longer. More money, including a fraction of pensions, is allocated to the private markets.

Private equity money goes to companies. They use it to expand. Lots of cash chases the few obvious winners and these command high valuations. This is the current state of investing in AI.

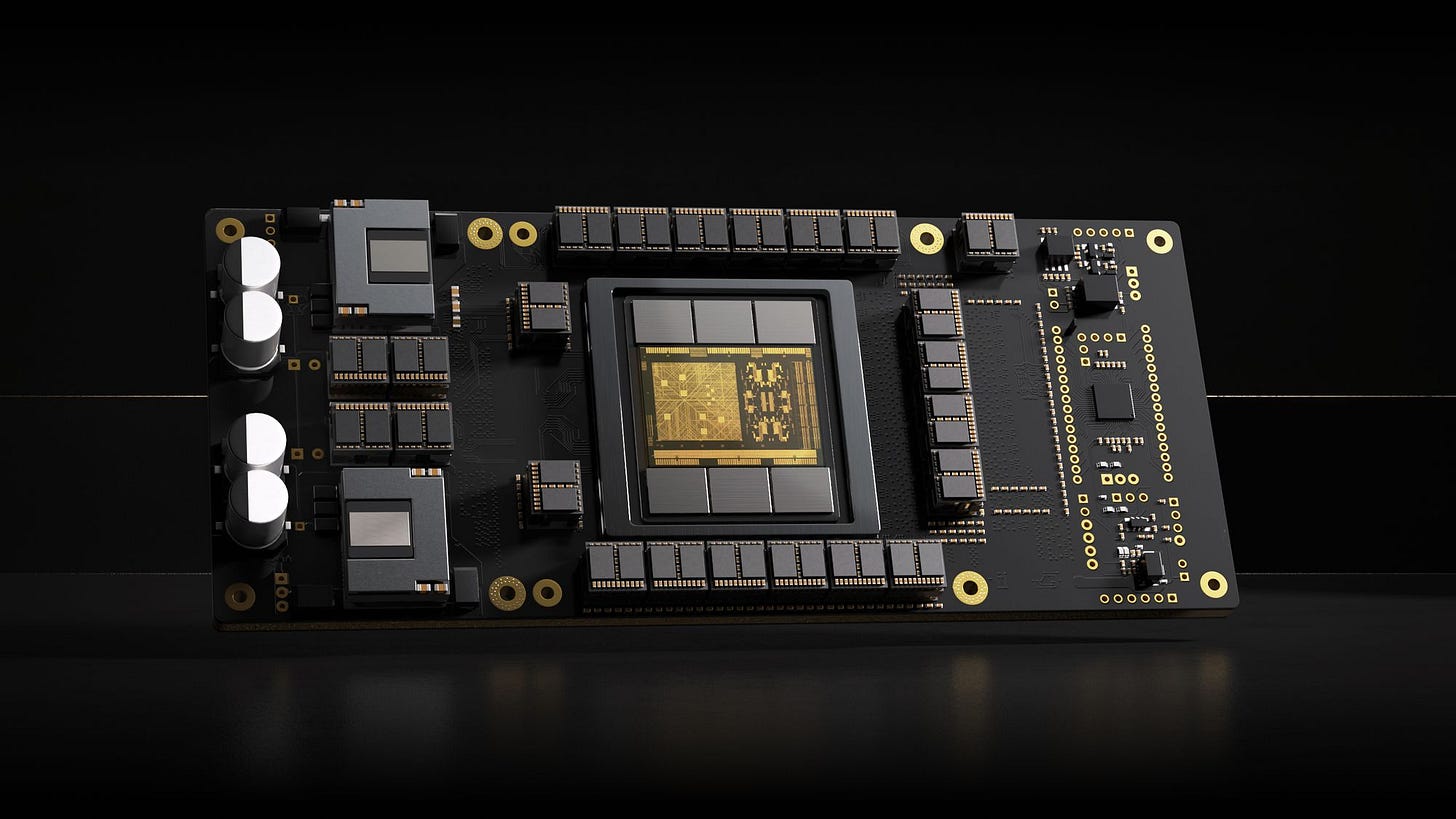

Technology changes come in three waves. The first is investing in making the technology. For AI this is semiconductors, data storage and power supplies. It takes a lot of electricity to run and cool servers.

The second stage is building using the infrastructure. Today that means generative pretrained transformers, the GPT in ChatGPT. Let’s call those large language models, or LLMs.

The biggest and final stage is the application layer. This is when useful products are developed using the models. The promise of vast fortunes is what drives entrepreneurs and investors. The risk of loss is nothing compared to the potential reward.

During the internet boom there was a bubble in fibre optic cable and then in internet hardware. The most money was made in the companies that use the internet to reach customers. These are Amazon, Apple, Facebook and Google, the last two now Meta and Alphabet.

Stock market analysts queue up to predict the rotation of investment from one wave to the next. Nvidia is an obvious bubble investment but the music keeps playing. For now.

A week ago a company called Etched announced Sohu. It describes this as “the fastest chip of all time. It’s not even close.” The company raised $120 million to build the Sohu semiconductor, which is purpose built for LLMs. It claims to be 15 times more energy efficient and 20 times faster than Nvidia’s top performing chip.

This is possible because Nvidia builds multi-purpose AI chips. Only 3.3% of the transistors on an H100 are for matrix multiplication, the engine of LLMs. You’d be forgiven for missing it, but there’s much more AI happening beyond the world of generating predictive text. Yet LLMs garner the investment and are a bubble. This is a good thing.

Analysts describe the flow of money from one wave to the next as if it’s a smooth transition. It’s anything but. One bubble bursts and another inflates. The earlier you enter the more money you make, provided you sell. Most do not and give back their gains.

This is the triumph of capitalism.

The Non-Worldwide Wide Web

The concept of creative destruction was popularised by Arthur Schumpeter in the 1940s. New technology makes the old obsolete. Money and jobs are lost by those backing and working with the old. Champions of the new technologies emerge on a higher plain of wealth. The competition to create better technology and reap ever higher rewards is what drives progress.

Overinvestment is a feature of capitalism. Technology does not emerge from the ether. It is built on the back of earlier innovation, as bricks stack up in a wall. The idea of LLMs is as old as Gulliver’s Travels, but it was almost 300 years before the computing power was available to make Swift’s The Engine a reality.

Innovation tends to be associated with a single person. Often they are the one to commercialise it best. Think Thomas Edison and Steve Jobs. The reality is that if these people never existed, the technology would have been delayed by months at most.

There are many options for investors when a new technology arises. ChatGPT is the leading LLM, but there are hundreds of significance. Increasing specialisation may prick ChatGPT’s bubble, once the pin has burst Nvidia’s.

Most alternatives will fail. Investors won’t get their money back. But the knowledge, the data centres and power supplies that enable these attempts remain. They will be used for the new and next ventures. The internet is what it is today, because of the overinvestment in cable and other enabling infrastructure.

China is building its own network of undersea cables. This has the potential to split the internet in two, with users forced to choose between US and Chinese networks. US hegemony is threatened but this demonstrates the inherent weakness of the Chinese model.

In a state controlled system, investment is directed by the authorities. The Chinese state has decided that undermining US monopoly of internet infrastructure, is in its long-term political interests. No capitalist would run this race as it was over decades ago.

No capitalist would re-shore manufacturing capacity and duplicate Chinese green technology infrastructure. This is why tariffs and subsidies are required. Hence Biden and Trump try to out-tough each other on trade in debates. The swing votes in the Midwest are manufacturers.

The reversal of globalisation slows economic growth and increases inefficiency. That is how cycles work. Arthur Hayes argues we entered the Pax Americana versus The Middle Kingdom cycle after the global financial crisis.

In capitalist systems, one team wins and reaps the rewards until the next technology arrives. Enemies are vanquished, unlike in geopolitics. Big countries cannot bear being second and regroup and rise again.

China over invests as much as capitalists, but deals with excess in a different way. Business and political figures vanish and investment is redirected. The Chinese stock market languishes because investors cannot predict winners. They may become losers on a whim.

Capitalism is a giant experiment in which the most popular innovation results in outsized gains. Category leaders are a minority but command three-quarters of the growth in company size.

A Beacon for the World

Communism is a constant game of catch up by direction rather than innovation. China is a hybrid, but one where government intervention is the ultimate power. The US remains the beacon for the world.

Contrary to popular portrayal, most migrants are the adventurous members of society who dream of a better life. One in five want to go to the US, according to the World Economic Forum, almost four times second placed Germany.

The dynamism of capitalism has been missing since 2008. Since then, Western authorities flooded markets with money at the first hint of trouble. US banks were bailed out, then European countries in 2012, and whole workforces during Covid. These acts of mercy save misery but delay the inevitable.

The authorities hoped to unleash a wave of risk taking and investment. Instead, armed with cheap money, companies bought each other. Even this is risky, so they bought their own shares instead. CEOs are still paid in shares, just like Chuck Prince. Using company money to boost personal wealth is rewarded by rising share prices. Those at the top seal themselves into a private bubble.

The pin prick is rising interest rates. Investments must now be justified because there are alternative uses for money. Positive interest rates are the price of money and give it value.

You Ain’t Seen Nothing Yet

Stock market commentators are floored by rising interest rates. Their models tell them that technology investments fall when rates rise. It takes a lot longer to get money back from technology cycles than from supermarket sales, for example. Higher interest rates mean that time is money once more. The cost of waiting should be seen in lower share prices.

Yet technology booms and the US stock market reaches a record number of highs this year. The animal spirits are unleashed. Those conditioned to the molly-cuddling since 2008 cannot understand.

Economic eras are named for technologies. The steam and electric ages. Pivotal technologies launch a starburst of innovations that transform economy and society. We are in the AI age.

A paper published in Science on June 20 this year, said only 1.8% of jobs can be at least half done by LLMs. ChatGPT will not steal your livelihood. It’s a bubble and will burst.

Then the authors said that a layer of applications on LLMs will impact 46% of jobs. Nvidia builds infrastructure, OpenAI the models, but the great game is for the applications and it is just beginning.

Google AI researcher François Chollet claims GPTs will earn around $6 billion of revenue this year*. He estimates that $90 billion of capital has been invested in the last two. The numbers don’t add up for LLMs.

McKinsey estimates that the appliance of generative AI will add $4.4 trillion to the world economy each year. That’s around 4%. The gap between these opinions is the chasm between waves two and three of technology cycles. Nvidia is stage one and flirting with being the world’s largest company. You ain’t seen nothing yet.

Every bubble bursts. The later you invest the more you lose. But from the residue rises new innovation with wider reach and significance than what came before. The spoils are great enough to inspire dreamers to overinvest time and again.

This is capitalism at work. It was crushed for a decade as the West became controlling. People seem surprised that China closed the gap. With interest rates meaningful once more, the West has its mojo back.

Stock market commentators say record highs are because investors fear a recession and expect interest rates to drop. The argument is that markets fall in the good times and rise in the bad. It depends on government intervention being the only game in town.

That is how distorted our thinking became after the crisis. The Queen might have asked why no one foresaw that.

* Many thanks to Byron Gilliam for this insight.