Deciphering the New Cold War: Global Power Dynamics Unveiled

Exploring the Intricacies of International Relations in the Era of Renewed Rivalries. It's time to take The Sniff Test.

More Milkshake Suckers

Last week I introduced Milkshake Theory. The biggest economies suck up international capital like milkshake from the bottom of a glass. It’s a fierce competition in a polarised world.

The US just passed a US$95.3 billion foreign aid package. Most of the money goes to the Ukraine, Israel and Taiwan. The package carries the rider that the Chinese company ByteDance sells TikTok in the US. It has 270 days to comply.

China was quick to respond. The stage is set for the new cold war between the two. Other countries will be forced to pick a side.

The package highlights the shift in US policy from military to financial might. No more boots on the ground. Instead the US is arms-dealer-in-chief to those who side with it and who do its fighting. The most important conflicts get funded.

China has no intention of its capital being sucked up. It was the biggest beneficiary of globalisation, but called time on that ten years ago by sabre-rattling in the South China Sea. Some call this is a strategic error. In fact it’s a calculated part of the 100-year plan to overhaul America.

Capital is the primary ingredient of the cold war milkshake. It is mobile and goes where it’s treated best. Technology is also mobile. Limiting its movement is a primary aim of superpower competition.

The New Economics

The biggest financial markets are the most robust. Size offers liquidity and choice. This appears to be self-reinforcing.

Since the Global Financial Crisis (GFC) the balance sheet of the Federal Reserve has increased from $600 billion to $7.5 trillion. The mechanism was buying low risk assets such as government bonds. As a result, investors took more risks and US stock markets outperformed. In so doing they sucked up capital from UK pensions.

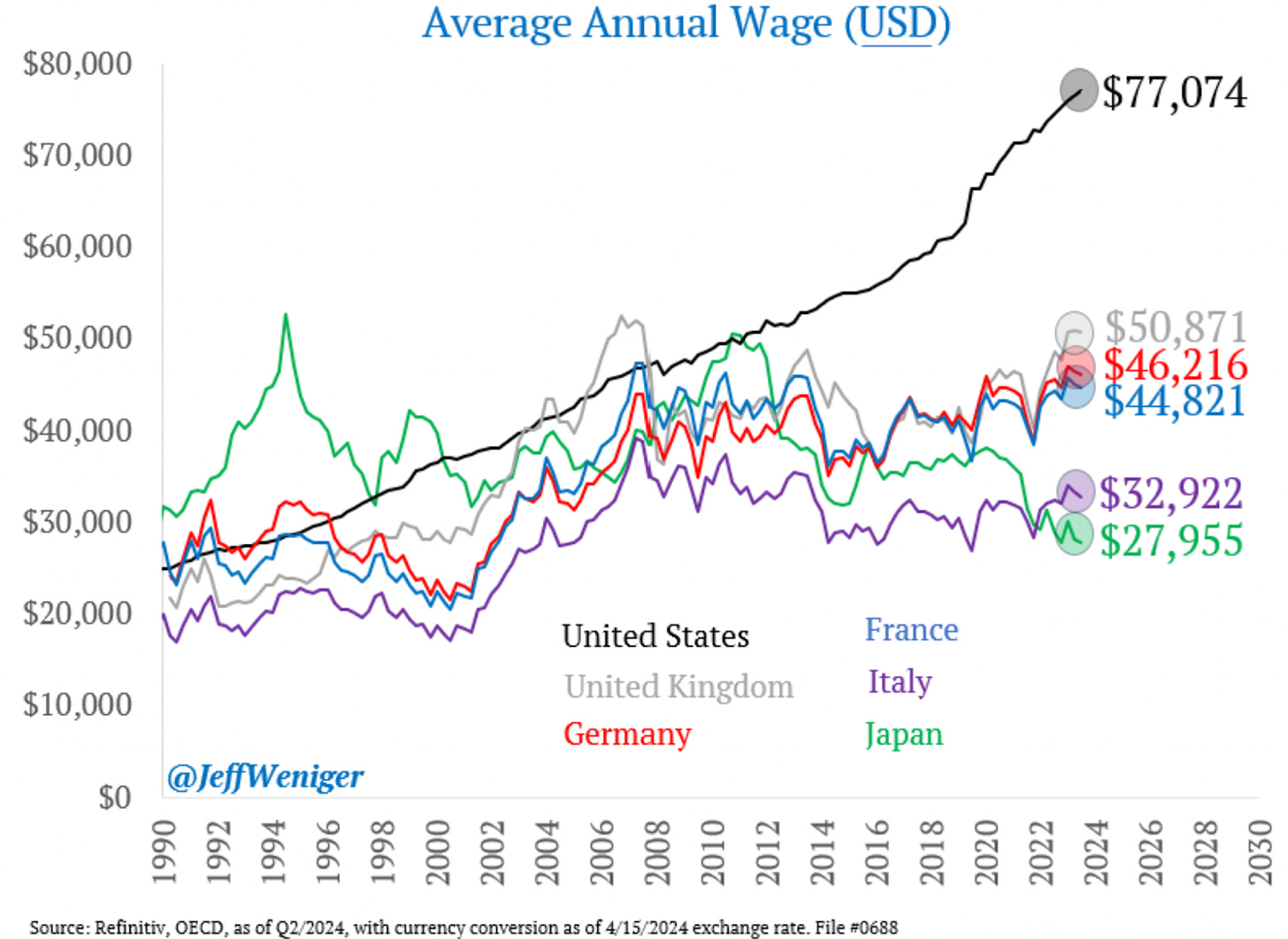

There are other benefits for America. Company margins grew from 8% to 12%. US wages soared relative to the rest of the world.

Creating capital is inflationary. The price of assets rises first, but when the government gets round to recycling the money, the price of everything rises. That was Covid-19 relief.

The best performing asset since the GFC is bitcoin. There’s lots of arguments why but only one reason. By design it goes up in value when the supply of a currency increases. There are lots more dollars, euros, pounds and renminbi since 2009 and bitcoin is worth a lot more in all of them.

The experiment with creating capital has been a huge win for the US. Having fixed its banks and a pandemic, it now turns to technology and world order.

Liquidity and Law

Liquidity means there is always a buyer if you want to sell. It also means the price you are quoted is firm. The bigger the market and the number of players, the more true this is.

The rule of law is important in upholding property rights. If you buy you need ownership guaranteed, despite whatever unpleasant news surfaces about you.

Innovation is also important. The largest markets don’t need to be bleeding edge, but they cannot stay still for long.

Liquidity and law make a safe haven. This is where money shelters during crises. Even when the US causes panic, its bond market sucks in capital.

China is a long way behind in developing capital markets. Its currency does not freely float and there are restrictions on the movement of capital. It sucks milkshake through a straw with a hole in it.

This handicap forces China to compete elsewhere. Artificial intelligence, clean tech and raw material supply are where the fight is most furious.

Global Fallout

London has been a global financial centre for a long time. It grew in importance even after Germany and the US surpassed the UK’s industrial production. Growth continued despite the pound’s diminished role in financing trade. London innovated to take advantage of US missteps.

The offshore dollar market was born in London. It blossomed thanks to innovative derivatives designed here. That was decades ago.

US attitudes changed. It understands money finds a way to move and goes with the flow. Right up until using financial sanctions as a weapon.

For the first two decades of the century countries could join the dollar system. The club rules were minimal and loosely enforced. The golden rule is reinvestment of dollars in America.

Now the use of dollars is constrained. Money will find a way to move and new systems will emerge. Countries have a choice whether to be in the dollar club or build a new one. This is the new cold war divide.

London’s Canary Wharf is reinventing itself as a shopping destination and biotech hub. London is the 7th largest startup city in the world according to Pitchbook. It’s nearest European rival is Berlin in 20th place. But the US and China are where the action is and size attracts size.

The US is also trying to control the movement of technology. This flows freely among academics and is controlled when owned by companies. The race is on to hoover-up intellectual property.

Compute, Models and Data

The development of AI depends on compute, models and data. Compute means an ability to handle data and requires expensive semiconductors. The demand for these is the story of Nvidia, tension over Taiwan and Act One of the AI narrative.

The cost and scarcity of the most powerful chips triggers model innovations. These do more with less, scaling by expansion of knowledge. The cost of computers fell along with increased semiconductor capacity, tracking Moore’s Law. As semiconductors approach the limits of quantum physics, model innovation becomes the driver of cheaper and faster AI.

Data remains the holy grail, however. China has more people, weaker privacy laws and all-in-one applications that centre data in a handful of companies. The Chinese state beat them up a few years ago so they are compliant.

The compensation is in policies such as forcing Apple to remove WhatsApp, Signal and Telegram from the App Store in China. iPhone sales are dropping, thanks mainly to reduced Chinese demand. US apps are unwelcome and unnecessary for the mass of the citizenry.

The forced sale of TikTok is mild gesture. Contrary to media messages, the app is not being shutdown or restricted. It must just be owned by Americans. There is noise around first amendment rights to free speech providing colour for the election campaign. Yet in a battle between free speech and control of property rights, the latter will prevail.

US capital and technology combine to make international investments. Microsoft spent $1.5bn on a stake and board seat in G42 of Abu Dhabi. In the process it forced out ByteDance and China. The Gulf Cooperation Council countries are an interesting place to test models, given fewer privacy issues than in the US. This also helps align the UAE with America.

Is Clean Tech AI?

One arena in which China has a clear advantage is clean tech. It was early to industrialise production through manufacturing subsidies and a decades-long policy of scooping up raw materials in developing nations. While the US pole centres on capital and culture, the Chinese one is about industry and trade.

The fallout is obvious at Tesla. China is the largest market for electric vehicles and by far the largest supplier. Weak financial results from Tesla have a few causes, but loss of share in China matters.

The announcement of a cheaper car caused Tesla’s shares to bounce. But hybrids are rising in popularity because of the slow roll out of charging infrastructure. Tesla championed the tech exodus from California and Musk is central to the industry narrative. This week he claimed that Tesla is an AI company and bigged-up robo-taxis and self-driving systems.

Those clinging to the hope of a global economy argue that the US should import clean tech from China and focus on AI where it leads. The bottomless subsidies in the ironically-named Inflation Reduction Act demonstrate this is pure fantasy. The redline was crossed in the South China Sea and neither side is backing up.

Taiwan remains a potential flashpoint, hence its inclusion in this week’s foreign aid package. Culture and geography tie it to China, while politics and economics favour the US. Its significance may be in the three-front strategy of wearing down America.

Minor Skirmishes

Apple looks set to secure rights to stream the 32-team FIFA Club World Cup starting next year. Covid delayed the inaugural tournament due to be held in China in 2021. The US will host the 2025 version. Will Chinese citizens be able to watch?

Meanwhile European luxury brands are taking a pummelling on the back of collapsing Chinese demand. This is a result of a weaker than expected economy, but may also signal the start of a pushback against Western brands. Cold wars do that.

Last week a senior Chinese government adviser made frank statements about the economy. The recovery from restrictive Covid policies and years of over investment in real estate is taking time. President Xi has said moderate growth is the new normal. A quarter of Chinese capacity is sitting idle.

Having provoked the US into a more restrictive policy, China was always going to have to adjust. Publicly admitting as much suggests the authorities are settling in for the long game.

What about Russia?

While discussing my bipolar milkshake theory last weekend, I was asked about Russia. The country has an important role to play occupying the US in both Eastern Europe and the Middle East. Add Taiwan, and Russia and China are looking to drain US resolve and resources.

Russia however, plays second fiddle to China. Its economy and population are too small to attract capital and it is overdependent on commodities. Here China has the upper hand.

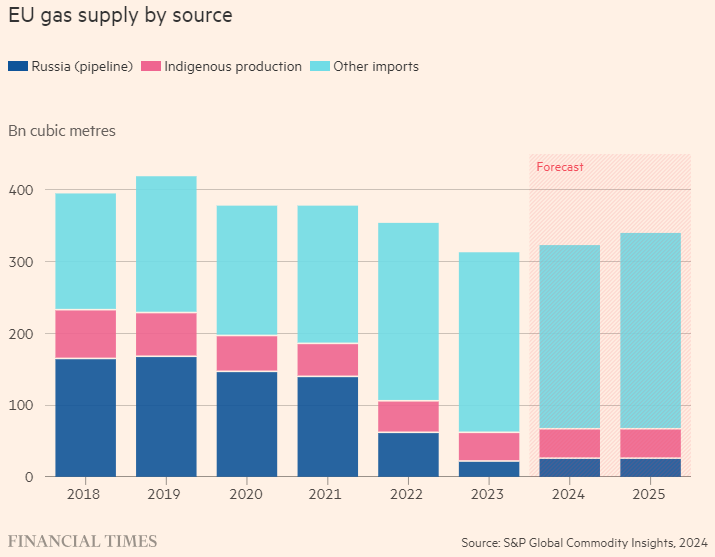

Russia announced this week that gas exports to China will be on average 28% cheaper than those to Europe through 2027. It always sold gas to Europe at market prices. The fuel was never cheap, even though it may have been cheaper than alternatives.

Since the advent of US sanctions, the EU has upped imports of Algerian gas and US LNG. Europe sits firmly in the US camp despite some domestic grumbling. China has energy options and drives a hard bargain for Russian gas. For all the talk of partnership, one player dominates.

Lines are Drawn

China entered the global economy through the World Trade Organisation at the beginning of the century. This was part of a longer-term plan to overhaul America, technologically, financially and militarily. An ability to fight depends on an ability to fund and hence a hot war was always last on the agenda.

The US awoke to this threat around a decade ago. It has followed a policy of containment ever since. This cannot have surprised China. It was building global networks through acquisition and finance long before the rupture.

The lines are now drawn. The fallout extends from capital centres such as London to the fashion centres of Paris and Milan. Iconic companies such as Apple and Tesla cannot avoid the consequences.

Countries such as India, Indonesia and Brazil try and stay aloof. Sheer size buys them time. In the end they will have to choose. Years ago Barrack Obama announced a pivot away from the Middle East. Yet how the region aligns remains the biggest unknown in the new cold war.