Fighting Inflation and the Tokenisation of Everything

Do the authorities know how to control inflation? Do they even want to? It’s time to take The Sniff Test.

If you’ve been playing poker for half an hour and you still don't know who the patsy is, you're the patsy - Warren Buffett

Inflation is a political killer. Everyone sees it, everyone suffers it and everyone expects the government to do something about it.

Yet inflation is also a tool of policy. After you pile up debt, such as during a war or fifty years of deficit spending, inflation erodes the value of that debt. Forcing savings rates to be lower than inflation is part of the policy.

How can that be when we have independent central banks with the job of getting inflation under control?

News flash: when the debt is big enough, the central bank’s job becomes to ensure government can fund itself.

Debts can be brought under control gradually if economic growth including inflation is higher than the rate of interest paid on those debts. For example, 2% growth plus 5% inflation compared to 6% interest rates.

This works provided that there is demand for the new debt that the government keeps issuing. If not, there is a crisis and a painful debt restructuring.

Who wants to buy debt that by design loses purchasing power over time? The hunt is on for the patsy at this poker table.

It’s always your fault

A recurring theme of The Sniff Test is that workers are tired of being the patsy. Working from home, quiet quitting and gig working are symptoms of a reluctance to continually do other people’s bidding. You may get paid less, but you have an element of control.

Governments and businesses don’t see this. They have been getting away with paying people less than the growth of the economy for forty years and cannot see why this would change. The red line in the chart is the size of the per person economy since 1980 and the lower blue line is wages after accounting for inflation. Grey shaded areas are recessions.

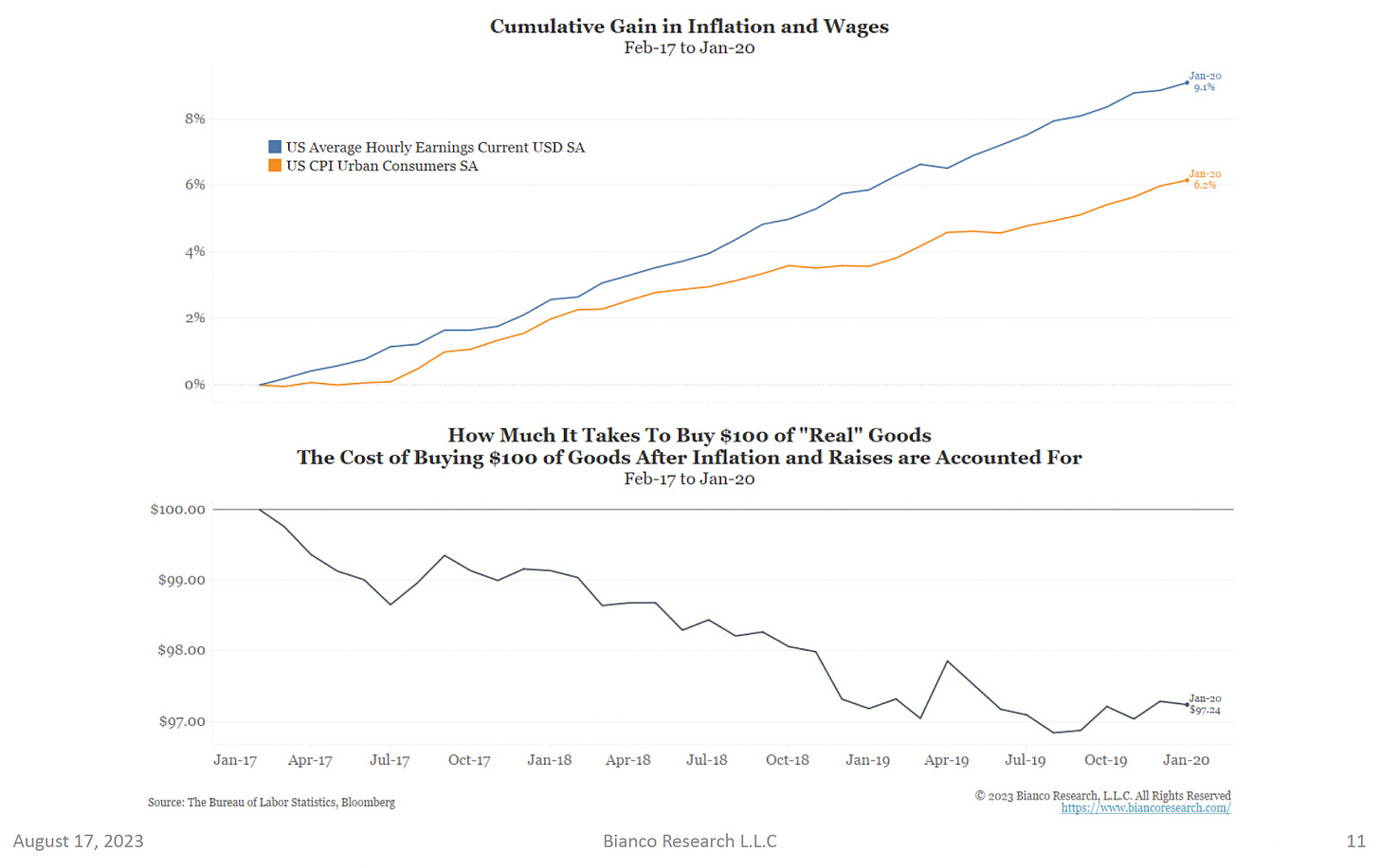

This leads to political surprises such as Trump’s election and Brexit. Economic confidence is about how we feel and can swing close elections. In this next chart, wages in blue are rising faster than the cost of goods in US cities during the Trump administration. The price of buying things is shown falling in black in the lower section of the chart.

In contrast, the chart below shows it’s business as usual under Biden, with prices outpacing pay. The respective presidents had little to do with this, but try telling that to any marginal voter.

This week’s YouGov poll for The Economist has Trump one point ahead of Biden. The establishment howls “But Covid, but Ukraine, but green economy spending; it’s not our fault”.

News flash: it’s always your fault.

As Safe as Houses

The traditional way to beat inflation is with higher interest rates. Increasing the cost of borrowing reduces the amount of new debt and slows the economy. Making people pay more interest reduces their spending on other things.

This works quickly in the UK because our mortgages are mostly variable rate. Banks raise the cost of mortgages whenever the Bank of England hikes interest rates.

Higher rates impact consumers much more slowly in the US because most mortgages are for thirty years. Borrowers decide when to refinance and no one chooses to do that when rates are rising. You can’t move house, which is why existing home sales in the US are at a low, but you can keep spending, which is why the economy has outperformed expectations in the teeth of interest rate rises.

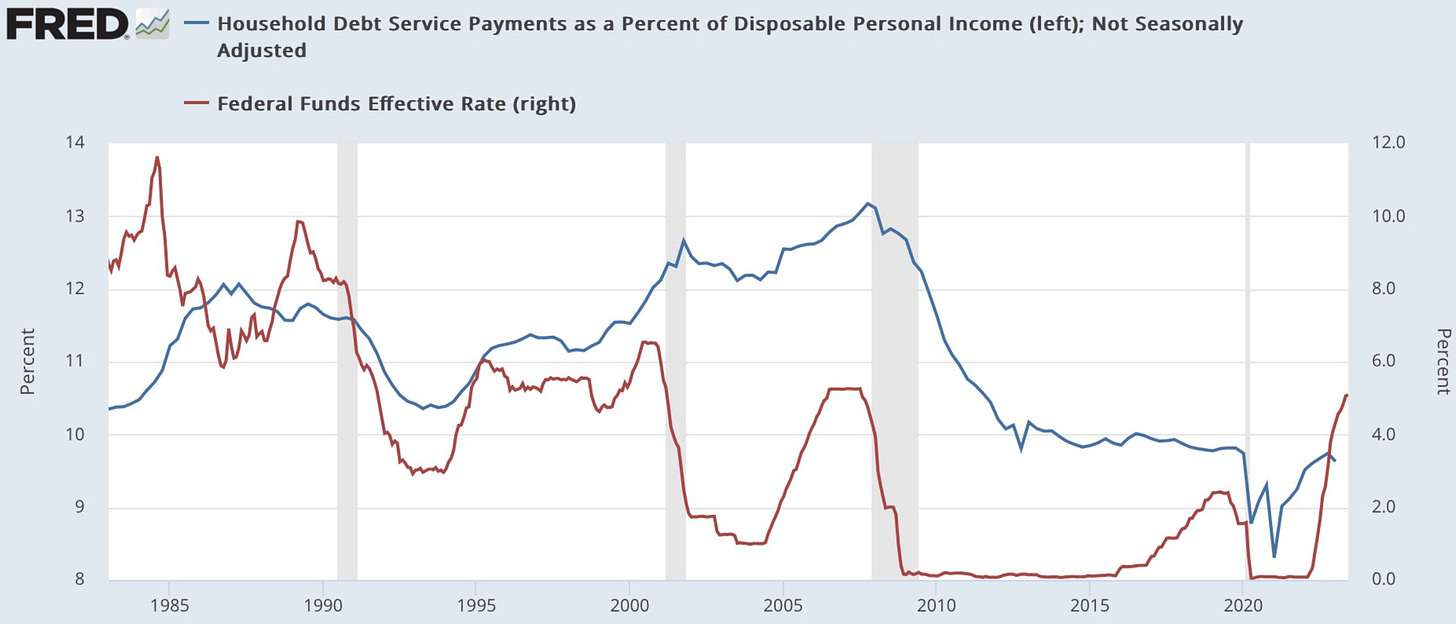

This chart shows US interest rates in red and the amount of money people are paying on debts in blue. Given how US mortgages work, the blue line has risen a lot less than the red.

Hitting people’s wallets through their homes is not a great political move. Houses are scarce and prices rise with inflation, but it becomes harder to afford them if your wages don’t keep pace. Non-home owners continue to be angry about the lack of housing and homeowners become disgruntled about the cost of staying put.

If we’re all going to suffer higher interest rates for longer, is this policy going to bring inflation under control?

Why debts must be curtailed

The authorities don’t just dictate what the rate of interest is, they play with the banking system to push rates in the preferred direction. The way to increase rates is to sell more bonds to banks, which sucks cash out of the economy, and to pay more interest on those bonds.

Meanwhile the banks receive the higher rates of interest on the reserves they keep with central banks and short term lending to the government. Banks have gotten very big since the 1980s with all the debt that’s floating around. Given how much lending to the government there is,

calculates that the Federal reserve in the US is paying more to the banks than it is taking from new bond sales.What worked to beat inflation in the 1980s, when there was a lot less debt, does not work in the 2020s. Each time interest rates go up the payments into the financial system are larger than the withdrawals from it. The central bank cannot control the cash sloshing around and therefore does not control inflation.

The solution is to limit government spending. Until then, we need someone to keep buying new debt, so let’s return to our hunt for the patsy at this poker table.

Our pension funds are stuffed full of debt, especially in the UK where regulations force funds to keep buying. We have to do this because, unlike the US, there is not huge demand from other countries for our debt. Yet even the US may be pushing the limits of international demand.

As well as our pensions, the other big pool of money that finds it hard to run away is in the banks. The authorities can increase the amount of reserves the banks must hold and dictate the return they get on them. These reserves must be invested in government debt.

Right now, the Fed is playing fair and paying market rates of interest on reserves. That will need to stop and when it does the profitability of the banks will be under pressure.

How big a patsy are the banks?

Small community banks are massive patsies, because they cannot go anywhere. They are full of long term property loans granted at historic low interest rates and cannot afford to raise deposit rates to match what the government is paying. Customers are pulling their deposits and the banks are slowly going bust.

This chart shows bank deposits in red taking a dive while assets in money market funds in green continue to rise.

The big commercial banks can move their business and have done so previously. The London financial markets received a massive boost when the US tried to clamp down on big banks in the past, because the most profitable business moved here. This spawned innovations, such as the derivative markets, which are now the largest in the financial world.

Big derivative markets - hold that thought.

Unlike last time, the Europeans are wise to what is happening and have no intention of being funded from the UK. We can expect more competition between London and Frankfurt, Madrid, Dublin and especially Paris. The French capital is the only city of similar size to London that can cope with the demands of international bankers for quality housing, education, infrastructure, culture and entertainment, and English is far more common place than it was shortly after World War Two.

What form might this intercity competition take?

You’re really bad at technology

To date, the crypto markets have been a damp squib. Bitcoin exists to be a scarce asset that rises in value when the authorities try and inflate their way out of debt. It’s gone up a lot since inception, but is not widely adopted, in large part because it doesn’t do anything.

Other reasons bitcoin is not in everyone’s wallets are because it cannot be used to pay taxes and the wallet must be digital. While technology is everywhere, we are bad at it and happy to surrender our privacy and attention to companies that make it simple for us to use the internet, our phones and the related applications.

Bitcoin’s appeal to the crypto bros is that it is beyond government control. That means the government need not compensate you if it is stolen and the law won’t enable you to get it back. You must be able to look after yourself, but most of us rely on Apple, Google, Microsoft, Amazon and ByteDance to take care of us.

We also rely on the big banks and financial companies to look after our money. This is partly due to regulations that give us little choice and partly because, as with technology, it’s too difficult to do yourself. A combination of finance and technology that made it easy to do more would be highly appealing.

By now you should have figured out that you’re the patsy at the inflation poker table, because your pension fund is full of government debt and your bank savings rate is going to be below inflation for a long time. But the need to squeeze big bank profitability to control inflation is going to play in your favour, because big banks aren’t patsies.

The Tokenisation of Everything

The same blockchain technology that gave us bitcoin, a digital token that represents nothing more that the effort taken to create it, will house digital tokens that represent things that are lot more useful. This includes commercial property, fine wine, art and the latest high technology companies not listed on the stock market.

Digital tokens are infinitely divisible, which means that you may own fractions of these assets, and investments that were previously out of reach will be widely available. In time, the regulations may even allow your pension fund to own them.

Of course, you don’t really own the assets, you own a digital representation and in most cases will never have access to them. The token that represents part of the asset is a derivative of it. The first wave of euro dollars escaping the US created derivative markets for financial instruments that could not be owned directly. This next wave will create derivatives of everything.

The big banks and finance companies will do this to preserve their profitability. Trading and warehousing financial assets is highly profitable and much less risky than lending or investing. Blockchain technology and tokenisation of assets makes both trading and warehousing much easier and faster, which means there will be lots more to do and higher profits to make.

The banks will do this because if they don’t then someone else will. As that someone else might be in China, the authorities will reluctantly go along with it and some authorities will be much more forthcoming. The race is already afoot.

The hunt for a 6 a.m. latte

The US Securities Exchange Commission has spent the last few years hunting down the crypto bros and an anti-token stance is part of its identity. It will be pacified by the entrance of big US firms, but it may be slow to allow some of the more exciting elements of this project.

Any dragging of feet is all the opportunity that international competitors will need. UK and European regulation, as well as that in Hong Kong and Singapore, is already favourably disposed to tokens compared to the US.

Blackrock and other US financial companies won’t care where tokenisation takes place. What they do care about is that you can get a decent latte at 6 a.m., educate your kids to Ivy League entrance standards and access art galleries to entertain clients at private events. They also care that their people can live in nice homes. That will be good news for house prices.

The tokenisation of everything will prevent homeowners becoming complete patsies after all.

P.S. if you want a much pithier and entertaining take on tokenisation then subscribe to Byron Gilliam’s excellent free daily newsletter.