How Britain Thrives in the New World Order

Government must support industry not pick favourites in response to Trump. It's time to take The Sniff Test.

A Little Less Bleak

The financial world is reeling from Trump’s tariff flip-flopping. In the media, last week’s opponents of capitalism are the champions of free trade today. Such is the President’s ability to create a photo negative of himself on every issue.

My top tariff article award goes to Mark Tinker’s takedown of the newfound economics experts. The gist is that if you didn’t understand last week, you are no smarter this. It is, however, far funnier than that. Humour is a powerful way to make a point. Mark’s main one is that there is no free trade and we are shifting from one manipulated system to another. He also believes that American multinationals manufacturing abroad are the prime target of the tariffs.

By many accounts last week’s Sniff Test was a little bleak. I am nothing if not responsive to readers, so let’s try and tackle what Britain can do about the new world order in a positive light. Keir Starmer said “the world as we knew it has gone”. He sees a chance for government to pile into industry to protect businesses, but is this what he should be doing? Let’s dig in.

Burn It All Down

In 2016, Ben Hunt penned an article about how awful a president Hilary Clinton would be, but unlike Trump, she wouldn’t break the system. He argued that Trump turns every Cooperation Game into a Competitive Game. At the time I didn’t get what he meant. I do now.

Every country has radical political actors that want to burn everything down and start again. We have environmentalists pining for a pre-industrial age, MPs who want to tax the middle class into welfare dependency and Dominic Cummins. He’s thrown his lot in with Reform and, to be fair, has a better idea of what comes after his scorched earth policy than most. Both socialists and populists reject the idea that economic growth should be unfettered, because they do not believe wealth trickles down to the masses.

Every few generations the world undergoes a significant change of direction. There are lots of theories as to why, but they are descriptions more than explanations. The Fourth Turning says upheaval comes every 80 years, while George Friedman notes that economic cycles in America last 50 years. He admits he doesn’t know why.

It’s 80 years since the end of World War II, the last Fourth Turning, and 54 since America came off the gold standard. In that time, the system saw the US importing goods from abroad in return for dollars. If Mexico, China, Japan and Germany keep the money, they will exchange it for pesos, yuan, yen and euros. The value of the dollars being sold would fall, making the US more competitive, and in time rebalancing trade. But this is not what happens.

The trading partners invest their dollars in America. Their money funds the government and allows it to police the world, finances innovative companies and pumps up the US stock market. For most of this century, after China joined the world trading system, the US trade deficit rose and the US stock market thrashed the rest of the world.

It stands to reason if the US uses tariffs to buy fewer goods from abroad, it will export fewer dollars to pay for them. That means fewer dollars will flow back into the US and, for one, its stock market won’t do as well. Raising tariffs in retaliation, accelerates the collapse of the trading system. If your economy is set up to trade with the US, retaliation is a bad strategy.

Some countries may decide to change their policy of making goods for Americans, and invest in innovation at home. They may also keep back some money to pay for their own defence. Some commentators think this is the purpose of the tariffs, but no one seems too sure.

Britain is Different

The British situation is different. We buy more goods from America than we sell to it, making us pretty unique. One reason is that, unlike Ireland, we are not a tax haven for multinationals. If US negotiators go after Ireland’s low tax regime, it may need new friends and soften its hostility to Britain’s trade negotiations with the EU.

Britain is subject to the lowest rate of tariff, which on Wednesday was applied to almost everyone except China, which has always been Trumps’s prime target. The UK has the option to do nothing and not too much will change. This chart shows the UK’s eight largest trading partners. We do the most two way trade with the US, while running a substantial deficit with China and various EU countries.

Since the early 1980s Britain has run a persistent deficit in trading goods. This means we must sell other things to the world. London is a financial and legal hub, as well as an attractive tourist destination. These are services that we sell to foreigners, which goes some way to balancing our appetite for overseas goods.

Here’s a chart of our services balance. Note the countries aren’t quite the same as in the goods trade chart, but there is no law that trade must balance with individual nations. The US is a huge market for our services exports, while at the other end of the chart we like to go on holiday to Spain.

Despite the strength of our services sector, we were in the hole to the tune of £41 billion in 2023. We recouped half of that with income from overseas investments, but then transferred it out again in foreign aid, contributions to the UN and by immigrant workers sending savings home.

We need to find more things to sell. UK properties and companies get snapped up and we borrow the rest from abroad. Cars are our biggest goods export to the US, but the profits go to foreign owners. Keir Starmer says he is standing by Jaguar Land Rover over tariffs. This is an Indian owned company that gets £1.5 billion of subsidies and loan guarantees from the tax payer already. Governments are bad at picking industry winners.

Starmer has promised an industrial strategy. Aligning Britain with EU policies would mean joining a block that uses regulation as a trade barrier. It is going be battling with the US for years. Even when we were in the EU, jealousy in Paris and Berlin over London’s strength in services made it hard for us to balance the trade books. Assuming Rachel Reeves can magic up more money for an industrial plan, we must be smart about how we invest if we want to keep buying foreign goods.

Definitely, Maybe

There was a second excellent Substack in the last week, this time by Michael Taylor. In it, he explores the resilient areas of the UK that thrive despite neglect from central government. He also introduced me to a new lifeform.

Michael’s point is that UK manufacturing is used to suffering and competes by being efficient. This means it hires talented engineers and scientists to make things, rather than lots of unskilled labour. Modern manufacturing is one part labour to many parts capital and the idea that reshoring industry will recreate the employment of the ’70s and ’80s is a forlorn hope.

What do Britons do for a living? Here’s a chart. Health and social work come first, followed by the car market. We don’t own car companies or make that many vehicles, but we import and sell a lot, especially from Germany. Manufacturing accounts for only 8% of employment, which is half the level in Germany.

To keep spending more on health and education, we have to find a way to pay for it. If there are fewer dollars sloshing around the global economy, then it will be harder to borrow. London will suffer because lots of the dollars that slosh around pass through here. Estate agents, private bankers and high end hospitality be warned.

With this in mind, Starmer might be best served using money earmarked for industrial policy to support housing. More affordable homes with lower stamp duties would protect people’s nest eggs, while helping workers move around the country to create new businesses.

UK manufacturing is used to surviving without government handouts. Rather than cherry picking preferred players, the government should invest to benefit all sectors. A government’s role is to provide services that the private sector does not, including transport links, ubiquitous communication networks and cheaper electricity.

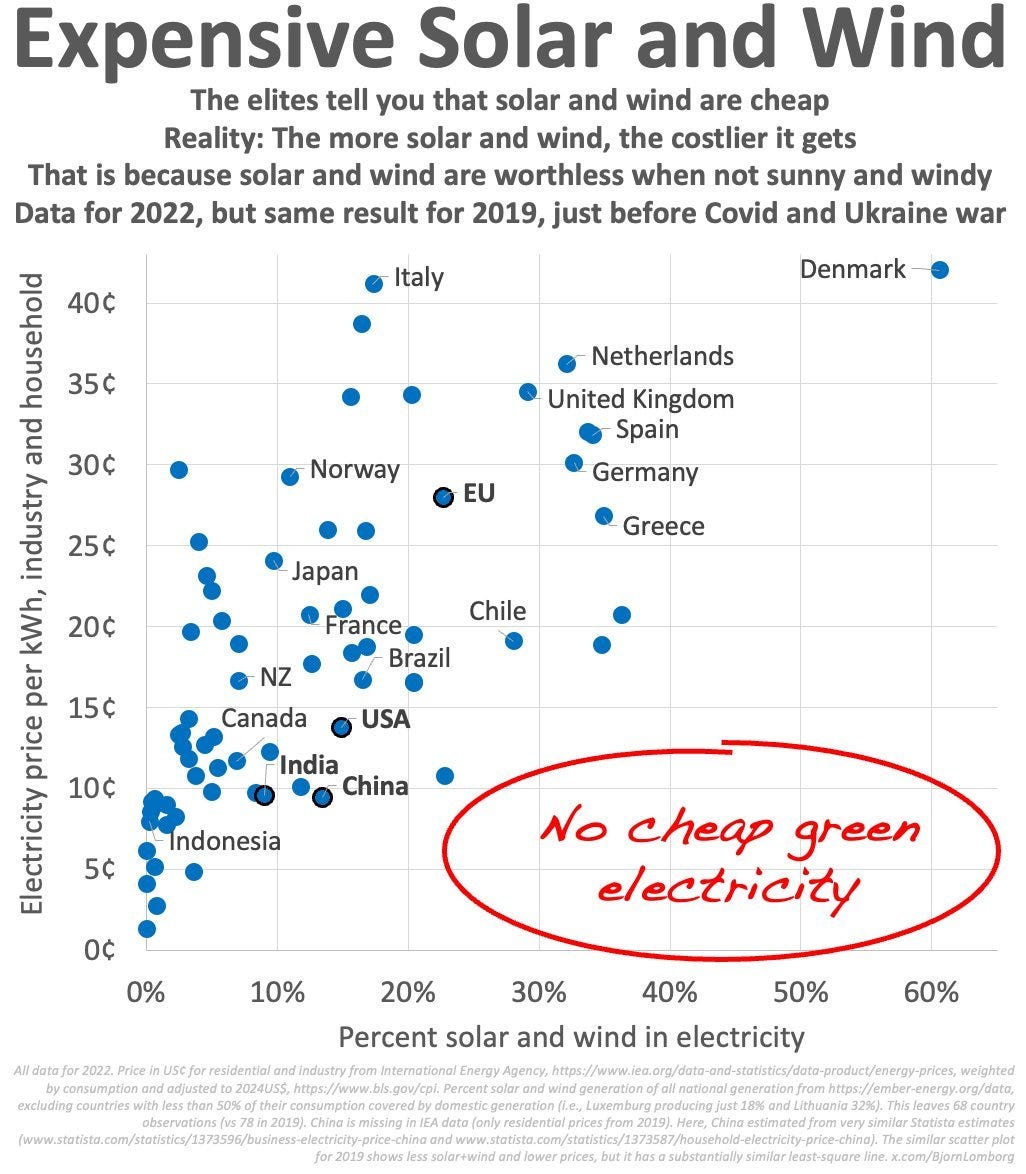

Energy is required to do everything. Lowering its price is the best way to boost British industry. Four-fifths of carbon emissions this century will come from China, India and Africa. The West can go bust reaching net zero and it won’t make much difference. Contrary to headlines, wind and solar are the most expensive forms of electricity, because they need fossil fuel backup for when they don’t work.

The world has enough battery capacity to store electricity for five minutes consumption. Three months is a decent safety net if we are to be 100% renewable. Instead of bribing companies like Jaguar Land Rover to build the odd gigafactory in Somerset, the government could reduce VAT and cancel the climate change levy on electricity to boost British industry. Making batteries may then be profitable.

Our new businesses should be built around artificial intelligence. This means taking a leaf from China’s book. US technology giants build ever-bigger models in pursuit of artificial general intelligence, but can’t release them in the EU due to regulation. China in contrast, lacking the latest chips because of sanctions the way Britain lacks them for want of money, focuses on embedding cheap AI throughout society. By making it available to everyone, which includes encouraging it in schools, Britain can entrust its academics, industrialists and financiers to rebuild industry. If you worry about AI taking jobs, then repeal Reeve’s taxes on hiring people.

Do I think Starmer will do this – liberate the housing market, invest in roads and high speed rail, and unleash AI in schools and wider society? I did say I would be less bleak this week, so let’s end with a definite maybe.

Thanks for the comment Simon! On your UK suggestions, I think the west needs to (re)learn the lessons of a mixed economy, where the public sector provides public goods, like education, health, transportation and utilities at high quality and low prices. Take out the producer capture of public sector unions and the egregious 'agency' costs of lex Greensill like middle men.

The issue is that, post Blair and Brown, the notional colour of the rosette has made no difference to policy, it has been a consistent muddle of centre left European social democrat, US inspired Crony Capitalism, Globalism and dirigiste wannabe central planning. Osborne thought Green was an Industrial Policy, as did May and now Starmer thinks making bombs is.

The idea that the government can create 'high quality jobs' is a vanity project that gets abandoned (when it doesn't work) and the politicians resort to 'being on the world stage'.

Best thing they could do is revisit Kwasi's Singapore on Thames plan and get rid of the Treasury and BoE instead this time!

During this weeks market turmoil (I missed Monday and Tuesday due to time off to cycle around Richmond Park instead) I noticed much focus on the reaction to Trump’s tariff, the 90 hiatus ex China and the strangely similar messaging from Jamie Dimon and the Bank of England about hedge fund deleveraging rather than systemic risk as US 10 yr yields moved towards 4.5% and the long end of the UK yield curve spiking to such an extent, the BoE were forced to announce only short dated gilt issuance from April 14th

But no mention anywhere about the $7trillion US refinancing due this year courtesy of Janet Yellen as Fed chair presiding over QE at the zero band from 2014, and as Treasury Secretary from 2022 issuing nothing but short dated paper, most of which in combination matures this year

One comment I saw cited the quote from Altabani from the 1969 Italian Job…”if they planned this traffic jam, they planned away way out” Given the Trump administration has known about this for years, and knows the main foreign holders of USTs (The EU and UK) are hostile to Trump, surely they gamed a solution to this refinancing dilemma?

So I notice Starmer’s rhetoric is still EU supportive but maybe recognises the end game to the current turmoil is an ascendant China, Russia and an increasingly aloof, inward looking USA

https://open.substack.com/pub/thepeacemonger/p/starmer-is-curiously-aligned-with?utm_campaign=post&utm_medium=web

Ian Proud, a former British diplomat in Russia, makes a good argument

The question thus is whether the Bank of England has done a deal with the Fed ?