How the world's financial system works and how it breaks

Leaders of East and West say they support the status quo but do the opposite. What happens next? It's time to take The Sniff Test.

I write about cycles, focusing on what they are and why they happen. But there’s less said about how they will unfold. If we knew this we could track how accurately predictions are working.

In 1803 John Dalton proposed that atoms of different elements are themselves different, which means atoms are not the core building blocks of the universe. J.J. Thomson discovered the electron in 1897 and it was more than 100 years after Dalton’s atomic theory that Ernest Rutherford demonstrated it.

Knowing something means having an explanation capable of a prediction. Theory comes before observation. There are branches of science that deny we know anything until we observe it, but these confuse certainty with knowledge. We know nothing with certainty, including the make-up of subatomic particles, because new theories and evidence keep emerging.

Cycles occur because the solution to a previous problem gradually becomes the problem itself. The international financial system since World War II is centred on the dollar, but is fraying as the reasons that it worked no longer hold. Let’s look at a theory of why this is happening.

Dalio’s Cyclical Theory

Ray Dalio has written a book about how cycles evolve. If you’re struggling to read the chart below it’s enough to know that the decline phase is large debts, printing money, internal conflict, loss of reserve currency, weak leadership and civil war.

With that noted let’s look at how the world works, leaning heavily on Arthur Hayes’ insight.

How the dollar system works

Most countries needed rebuilding after World War II. The US provided money to victor and vanquished alike and occupied Japan until 1952. Particular effort was made to ensure that Germany and Japan flourished, because onerous reparations forced on Germany after the First World War, played a meaningful role in the rise of the Nazis.

Both countries adopted a mercantilist policy. In simple terms this means manufacturing things to sell to America, and Britain to a lesser degree. US money kickstarts the process and thereafter profits are recycled into making more goods for export.

The US buys these goods on the condition that they are invoiced and paid for in dollars. It’s necessary for wages in Germany and Japan to grow more slowly than productivity to generate a surplus of dollars. This must be invested in US financial assets and in particular government bonds.

In turn, the flow of dollars back to America recycles into investments, often internationally in support of US economic and political priorities. This generates profits for US companies, the cycle turns and the world grows in peace and harmony.

The dollar was backed by gold from 1944 till 1971 when the US abruptly stopped the practice. There is not enough gold to back the volume of dollars that the system is capable of creating, while also holding the dollar’s value in gold. The ensuing decade was chaotic and inflationary, but delivered a new deal whereby the US buys Middle Eastern oil provided the trade is in dollars. The system was refreshed.

Thereafter, the high interest rate Volcker era of the 1980s re-established trust in the dollar based on the US making, policing and playing by the rules of the game. There are parallels drawn between the Powell Federal Reserve today and the Volcker version, which boil down to whether the US can maintain trust in the dollar.

One reason why the demand for dollars rocketed was that more countries were adopting mercantilism and relying on the US as the ultimate consumer. South Korea was rehabilitated this way after 1950-53 war, but the big prize was integrating China.

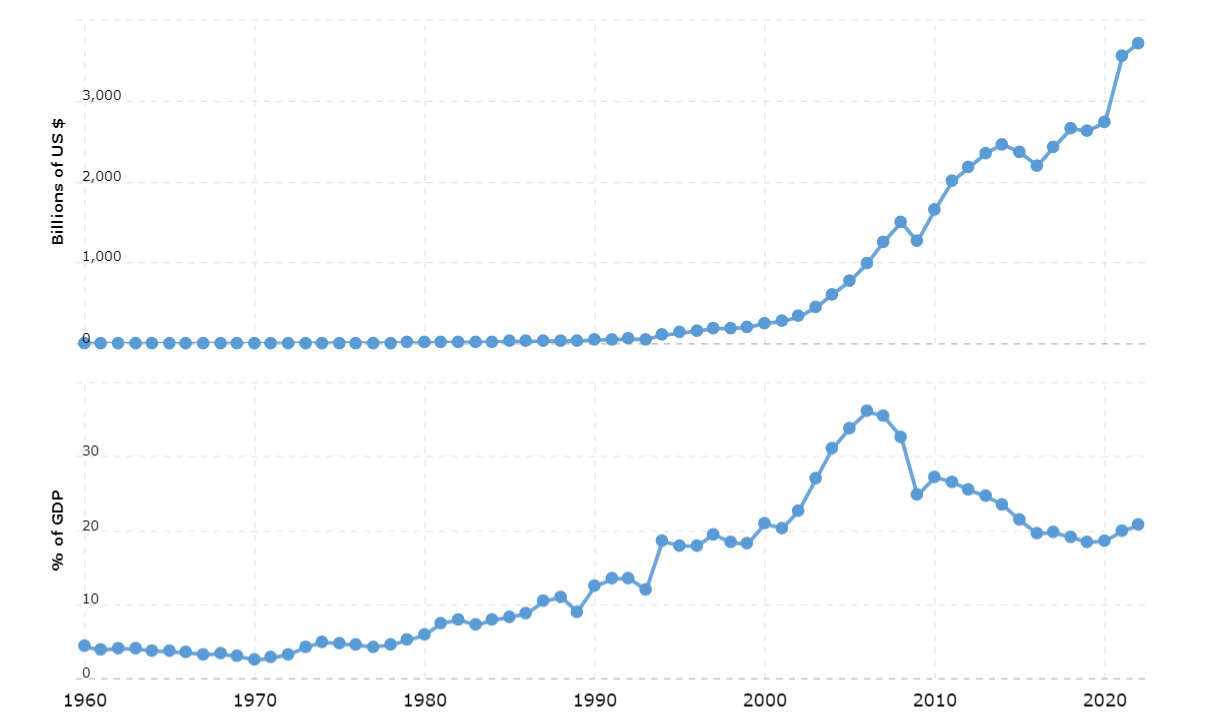

China joined the World Trade Organisation in 2001. This supercharged its economy, the demand for dollars and US financial markets. The chart below shows Chinese exports in dollars on top and as a share of its economy on the bottom. Note how trade matters less to China today than 20 years ago.

Economic growth is a result of population expansion and productive investment. Investment means savings on one side and debt on the other. One person’s asset is another’s liability and the books balance.

We call money in your account a credit because your statement is from the bank’s point of view. Assets are what someone owns and are called debits, while liabilities are what they owe and are credits. The bank owes you your deposit, which means it’s a credit for the bank.

How the system corrects

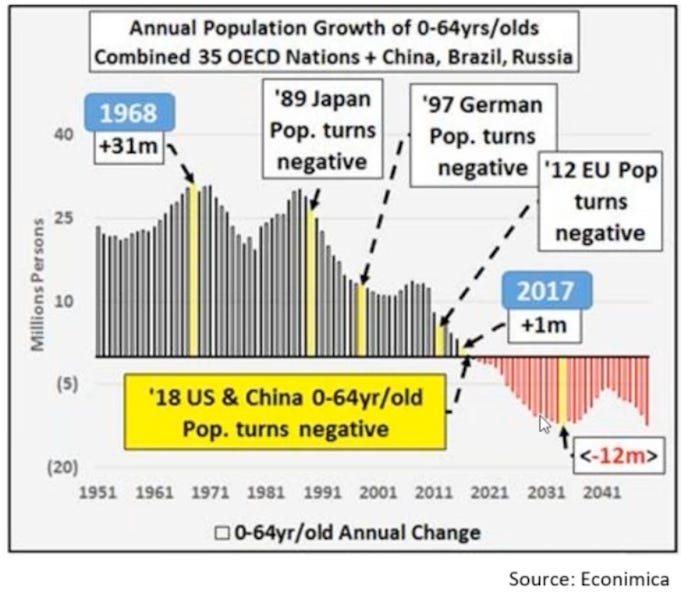

Accounting lesson aside, you’ll note that when the population growth slows then so does the economy. Demographics are the single most powerful long-term economic force and the hardest to do anything about. The rich world is running out of working age people.

China forced people to not have babies, oversteered and then incentivised them to have more. They didn’t and the Shanghai Academy of Social Sciences predicts a population in 2100 of 587 million. This is over 800 million people fewer than today.

Western countries offset ageing through immigration. At first this was working age men to fill factories but now is either sex to do anything the domestic population considers too lowly. Part of what makes jobs lowly is poor wages, which keeps costs down for companies, and business loves immigration in support of the dollar system.

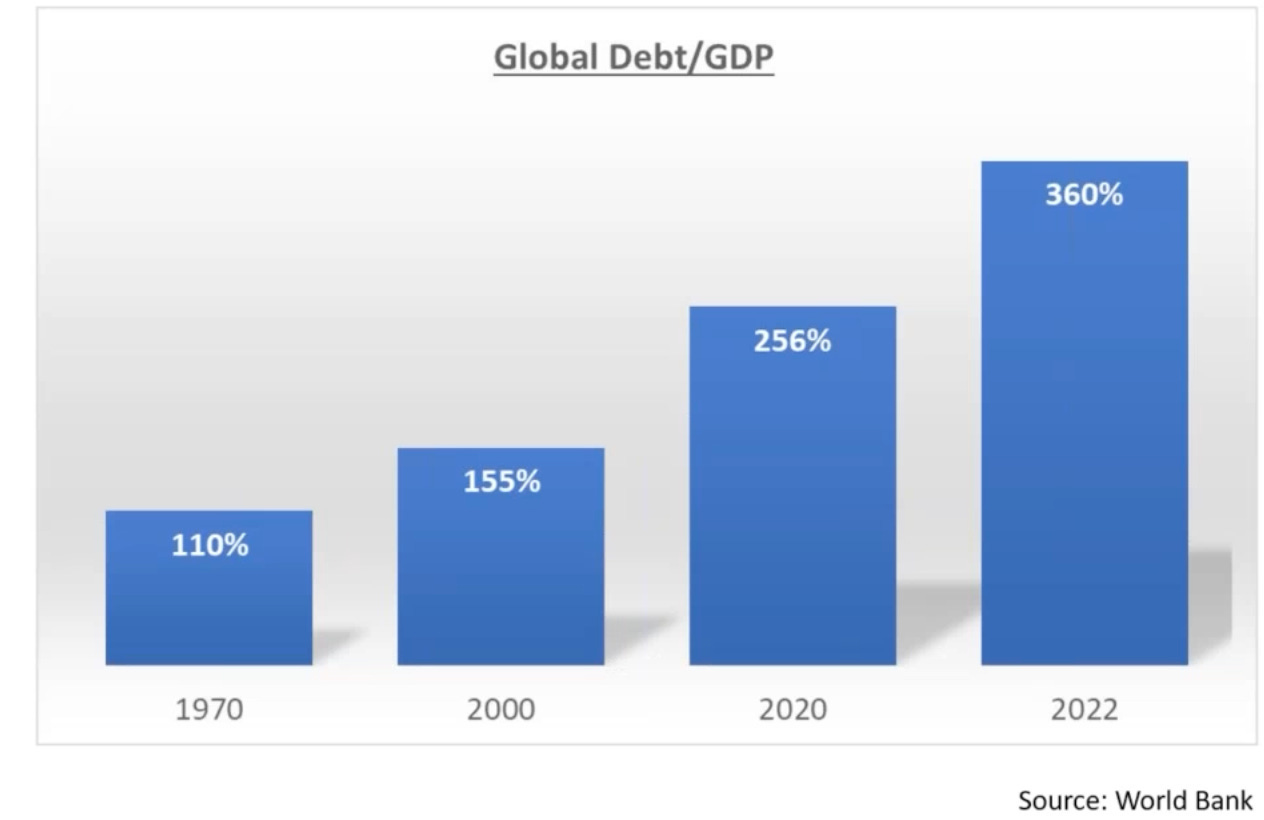

The other way to offset slower population growth is through more productive investment, which means more debts. We are good at piling up debts.

You don’t know whether investment is productive until long after you’ve spent the money. This is a particular issue for governments when investing in long-term projects that the private sector might avoid, such as transport, healthcare and basic scientific research. Because of this uncertainty there is a tendency to over promise on the returns of tomorrow to rip-off tax payers today. Here’s Michael Taylor on HS2.

If you spend a lot of money on handouts to people, for example during a pandemic, then you pump-prime the dollar system. People buy stuff from overseas, the dollars earned in Germany and China flow back into financial markets and the wheel turns. If it spins too quickly then things break and goods aren’t made fast enough, there are too few ships to carry them and not enough Amazon drivers to deliver. The price of everything shoots up, which we call inflation.

How the system wobbles

When the working age population falls we are entirely reliant on increasing debt for growth. But there is less demand for goods in the West as people no longer have well paid jobs, because things are made in China.

Now India, Brazil and South Africa want in on the act. As the West can no longer consume all the goods made, other countries start trading among themselves and questioning why they use dollars.

How the system breaks

US workers have enough stuff, especially after the paid-for Covid binge and just want a meaningful job. They vote for politicians who will Make America Great Again. The US issues more debt but this time it’s to build factories in the US, especially for semiconductors, clean tech and artificial intelligence. Not much of Middle America is qualified for these industries and the peasants revolt.

The new American factories compete with China, Germany and Japan meaning they earn fewer dollars and invest less in US financial markets. Prices fall and interest rates rise. Countries lose money on their dollar assets and sell them. There is no one to buy them and prices collapse.

Factories in China, Germany, Japan, India, Brazil and South Africa go bust and the peasants revolt.

An alternative outcome

The US won’t sit idly by while its financial system implodes and destroys private pensions at the moment the largest ever pool of voting retirees wants its money. People always warn about debt levels and yet the wheel turns and nothing happens. This time is no different and the Fed will jam down interest rates, print dollars and financial assets will soar.

This is forced demand for dollar savings. Inflation means we spend more and save less, baby boomers are retiring to spend and other countries are selling. Central banks are supposed to sell too, to control inflation and commercial banks are technically insolvent, having been forced to buy bonds at much higher prices to support the Covid era blowout. They also have to deal with bad loans to property developers whose buildings are half empty because we’re working from home.

What happens next

Our leaders flourish in the dollar system and it’s all they ever known. They will fight to preserve it and force us to buy assets through pension and banking “reforms”. Those who can will move money as far from government influence as possible.

The huge investment into semiconductor capacity and clean tech in the US is only possible with subsidies and tax breaks. The private sector has no reason to build these factories because it is perfectly happy with dirty work being done overseas. Subsidies distort incentives and force money into projects that would not otherwise be built.

This is bad for productivity because the private sector is investing in speculative, long-term subsidised and politically motivated projects, and not the profitable investments it usually makes. As productivity declines then even more debt is required to goose the system.

This happens despite the opposition of the rich because the peasants are revolting. Governments are supposed to keep the riff-raff under control, but the culture wars and clickbait headlines are getting boring. Deep down we crave meaning and a decent job and eventually governments cave in and unpick the global supply chain, undoing the dollar system in the process.

Show Not Tell

Small countries are never able to get away with printing money. Argentina, Zimbabwe and Turkey require authoritarian regimes to keep the people from revolting over inflation, while failed states in Sudan, Lebanon and Syria have even higher price increases.

Now it’s the turn of the mid-sized economies. When Liz Truss announces that Britain will spend its way out of a hole, she’s gone in a fortnight. Japan reverses a 35 years old policy of money printing and in doing boosts the attraction of Yen assets at the expense of dollars, adding to the selling pressure in the US.

The US and China are the last ones standing. President Xi met US Senators this week and made the unconvincing observation that a Chinese challenge to US superpower status is not inevitable. The Senators replied that America is not decoupling from China, which they want to believe as it means the dollars keep flowing to use in rebuilding US industries and keep politicians elected.

Yet in the same week the Chinese State Council chose to publish that contracts under its Belt and Road Initiative total $2 trillion, although priced in Renminbi. The Initiative funds new trade routes outside of the West and naval bases for China to become protector of the seas. As with much Chinese policy it harks back to the Middle Kingdom’s place as the centre of the world and thereby dismisses the last few centuries as an anomaly.

Countries participating in the Initiative owe $300 billion equivalent to China’s Export-Import Bank. China and the Renminbi now matter more to these countries than the US and the dollar.

The Euro version of the dollar system

The EU runs a continent sized version of the dollar system priced in Euros. Germany plays the same role, but as the largest economy requires everyone else to combine to do the US job of consuming. Germany lends money to the periphery to buy its goods, receives the euros back as payment and makes more loans.

If you can’t read the chart, the huge surplus at the top is Germany and the lesser one France. The big deficits below are in Italy, Spain and Greece.

As its population ages Germany imports more workers. Originally these came from Turkey, but now it’s further afield. Populations still boom in Africa and the Middle East and with insufficient local opportunities, young men head north and west.

When Germany calls on other nations to take their fair share of migrants it’s forgetting how the system works. While it grows by having a rising productive population, the rest of Europe grows via rising debts. They don’t need the migrants, have nothing for them to do and are revolting.

End Note

The future is uncertain. We reduce this uncertainty by better theories of how and why things happen. While theory precedes evidence, indulge me with an observation. Every empire in history and its supporting financial system has collapsed. Why will the current one be different?

Superb article that nails the rise and fall of the dollar empire (and maybe sees the rise of the multi polar BRICS which may be a de facto gold/commodity based trading system which the European Common market should have been, but never was because the single currency was always part of the centralising agenda)

My only additions would be firstly regarding German exports over the last decade between the Greek (sic German and French banks) bailout in 2011 and 2020, that it sucked in dollars printed by the accommodating Yellen led Fed, because the EU Commission imposed fiscal compacts on the non exporting members which more or less left the EU periphery in a decade long recession whilst the EU proclaimed tepid growth of circa 2% driven entirely by German exports, as a great non inflationary success.

This I think is important now because the offshore dollars grew in the EU to an estimate $3 to 5 trillion and is what Powell has been targetting through rate hikes and QT, draining offshore dollars out of Europe

Secondly, the Liz Truss debacle exposed the Bank of England aligning monetary policy with the ECB to manage the yield curve to try and stop the dollars flowing back onshore. Its noticeable that the most recent US Treasury publication of overseas holdings of USTs shows the largest position is held, not by Japan or China, but at $1.5trillion across member states, is held by the EU. The UK has risen to $700bn.

Despite that it is now clear the yield curve is finally steepening despite the coup to oust Truss although

Yellen at the Treasury issuing short term debt to try and flatten the curve now may hold off the inevitable for a little while

Thank you for an excellent read

Tom Luongo Fed v ECB.

https://www.youtube.com/live/mPxe_x8eqJU?si=PprxJLRWOyXIzYao

UST Foreign Holdings.

https://ticdata.treasury.gov/Publish/mfh.txt

Mark Blyth - The neo liberal implosion and the Athens Interview from 2016 where he identifies the peasants revolt brewing.

https://youtu.be/rGvZil0qWPg?si=VxeWqjTLjgdgc8nz

https://youtu.be/5_m28pNiMYs?si=3lNiPC_LlIWISkci