Short and Long Term Thinking

What does the Bitcoin ETF story tells us about how we should think? It's time to take The Sniff Test.

Theory of Everything

The film “The Theory of Everything” is about Stephen Hawking’s triumph over adversity. The title refers to the search for a unifying theory of physics, which continues today. At various times different theories are championed as potential answers, but we are some way from uniting general relativity and quantum mechanics.

Humans yearn for big answers. The meaning of life, the existence of God and explanations for why things happen. We climb the mountain but the peak is always over the next ridge.

The Greek poet Archilochus said “A fox knows many things, but a hedgehog knows one big thing”.

Isiah Berlin developed this idea for writers, arguing they either had a defining idea or used many experiences to show there is no such thing. Psychologist Philip Tetlock adapted this to political forecasting, concluding well-paid pundits with one big idea were more often wrong than right. The world is shades of grey rather than black and white.

Is it?

A Cautionary Tale

Full-time gamblers and traders understand there is no single reason why horses win races or share prices rise. There is a likelihood of something happening and there are bets and trades on whether it happens. The two are related but different. The professionals play the odds, meaning they adjust positions based on how everyone else sees the outcome. They are foxes.

Professionals make money at the expense of amateurs who have one view of the world. Seeking explanations often means looking for someone to praise or blame. For example, Steve Jobs revolutionised mobile phones and it’s Trump’s fault.

The financial journalist Tim Harford hosts a podcast called Cautionary Tales. He retells stories of disasters to reveal why things happened. After 50 episodes he summarises the reason as either system failures or bad luck. But the narrative of each event is an individual was to blame. People make better stories and scapegoats. The faulty system changes less often than it should.

No Sure Thing

Professionals traders are said to pick up pennies in front of a steam roller. They place many small trades with low payoffs, effectively betting that major events don’t occur. Professional gamblers back favourites not rank outsiders and may bet against the longshot. The benefits of this strategy are marginal and positions require constant vigilance, which is too stressful for most people. Imagine betting against a result that, however unlikely, would bankrupt you. You may literally be betting your house.

Machines think in numbers better than humans. They spot patterns we do not, crunch infinitely more data and work faster without tiring. Stock market trading is mostly machines. Whenever a quantitative fund puts a new theory to work, others jump on the trend and arbitrage the gain away within months. It gets easier to be a human playing the odds because the machines to help you get cheaper. It is harder to stand out as a human playing the odds because more people are doing it.

The result of a horse race is black and white, but there is always another race. Professionals know not to go all in regardless of how favourable the odds. Trading and gambling are about durability, not waiting for one big win. Foxes profit from the hedgehog views of others, the mistaken belief that an event has a single cause.

Candy for Hedgehogs

Financial writer Morgan Housel tells a story about Warren Buffett. The legendary investor is often cited as an example of a hedgehog because he makes long-term investments. How he invests has changed, but while the form of his investments evolves the substance is the same.

When asked how America would ever recover from the crisis of 2008, Buffett replied with two questions. What was the best selling candy bar in 1962 and what is it today? The answer to both is Snickers. Life goes on with ups and downs but fewer changes than we assume.

Buffett looks for moats around companies. This means competitive advantages that sustain superior returns far longer than most people imagine. The best moat is a law that protects you from competition but there are many more if you know what to look for. Careers are made divining Buffett’s secret from his annual letter to shareholders. The substance of his success is sustainable outcomes.

Buffett invests mainly in America. Compared to many countries, the post war period in which he made billions has been politically stable and economically successful. Theories of long-term cycles predict upheavals to the status quo that might upend Buffett’s way of thinking. Yet it’s not unreasonable to assume that after a debt reset and generational transfer of political power, Snickers will still be top choice a decade from now.

Dedicated or Diversified

Nicholas Nassim Taleb made a career taking long shots. As a trader he would make lots of long odds bets and a few would pay off. The problem with this strategy is that it loses money most of the time, even if the wins eventually pay for the losses.

Venture capitalists adopt a similar strategy investing in startups. One or two winners pay for the majority of companies that fail. But venture capitalists take an annual cut of the fund as well as profits on the winners. Very few only get paid when they are right.

Taleb is no longer a trader. He found more success as an academic, author and social media provocateur. He says the change was because he did not want to be known as a trader. It may also be because there are few people prepared to take regular small losses in return for one big gain. It’s tough being a hedgehog in an industry of foxes.

Why is Buffett’s long-term approach celebrated while Taleb’s is not? When something has a finite deadline then trading on the outcome is a zero sum game. One side wins while the other loses. Amateurs retire licking their wounds, while professionals start again. This is why you are best not trading options unless you think in probabilities.

There is no deadline on Buffett’s investments. He is betting on the success of the US economy through time and picking the winners in it. Things get progressively better and investing in shares is rewarding for everyone. If you don’t know what you are doing then you buy a diversified exposure to lots of things. If you are Warren Buffett you bet big on a few winners. Buffett has dedicated his whole life to his passion.

Know Your Timeline

Buffett doesn’t bother with the level of the stock market. He watches individual companies. Forecasting is not investing.

Why are so many forecasters employed when they are most often wrong? Because forecasting is not about being right. It is about who is listened to and what is the purpose of forecasts.

Goldman Sachs predicts the stock market will rise, again. They are cautiously optimistic, as are other advisers. They are paid more when markets rise and employ professionals who want an optimistic story to tell customers. Cautiously optimistic of course, because no one wants a gung-ho adviser.

Cautiously optimistic is a hedgehog view. It works over time. Foxes will make many trades in this period and care less about the long run. When you invest with someone, ensure that your time horizon is similar to theirs.

Safe as Houses

This week the Securities Exchange Commission finally conceded that bitcoin may trade on an exchange. This is an indirect investment in a fund and does not confer ownership. You own a share of an investment that owns bitcoins. Does the difference matter?

There are three hedgehog ideas of bitcoin, but there can be only one reality. The first idea is that it is money and can be used to buy things. The second is that it is how things should be valued. The third is that it protects you from the long-term devaluation of paper money.

Only one of these works within the current system.

If you live in Argentina then you welcome new money. The new President wants the country to use dollars because it has proved so poor at managing its own currency. One or two countries have adopted bitcoin. But the dollar works well for most and does not need replacing. Bitcoin is not money.

As it is not money, it is not going to be how we account for things. If you spend dollars, pound or euros most days then this is how you think of money. You want your bank account showing how many dollars you own.

Bitcoin has done better than every other asset of note since inception in 2009. It has done better than most over shorter timeframes. It works as protection against the devaluation of money because it is priced in dollars (or pounds, or euros).

As the supply of bitcoin rises slowly to a peak around 2140, and the supply of money rises rapidly, the money price of bitcoin goes up. The same thing applies to gold, houses and anything with less new supply than money.

One Big Idea

Bitcoin is a lot less useful than a house and marginally less than gold. Its use case is evolving while gold’s is not and it might end up being more practical. That probably doesn’t matter.

Professional traders and Buffett both know that something is worth what others will pay for it. Trading foxes focus on this price and adjust their positions accordingly. Investing hedgehogs care less for price signals, relying on people to catch up in time. For both bitcoin has value provided others think likewise.

Putting bitcoin in a fund increases the number of people who think it has value. Hence the price should rise through time. But only if it continues to be an offset to the creation of money.

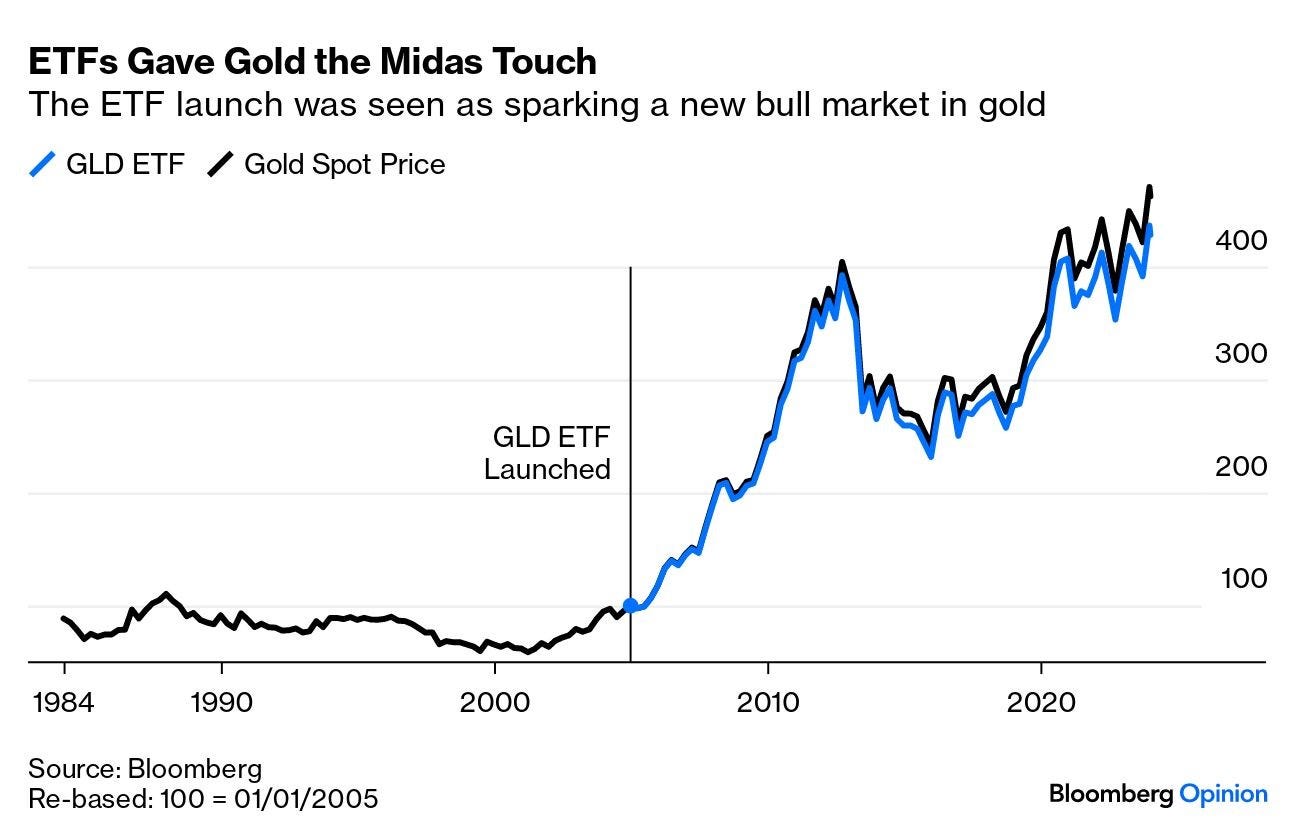

This chart appeared in Bloomberg Opinion overnight. The premise is that the gold price took off when it became investable in a fund. Gold bugs screamed that you don’t own bars and hence had no protection from Armageddon. But most investors are not betting on Armageddon, they are betting on rising money supply.

The chart does show the price of gold rising a lot after it became tradable in a fund. That is a correlation not causation. It also shows us that the fund is a reasonable but not perfect proxy for the price of gold. It’s cheaper and easier to buy a fund than to buy and store gold bars. Therefore more people buy the fund.

The chart does not show us why gold went up. Here’s a longer term take on gold.

The price of gold and houses rose about the same over a century. If your big idea is to buy either you will be right. But not because it’s gold or a house, but because the supply rises more slowly than money supply. Your hedgehog idea works, but not for reasons to do with what houses and gold are for.

Right and Wrong

In his essay Berlin analysed Tolstoy as a fox driven by a hedgehog’s belief. Berlin thought this caused great pain to Tolstoy in later life. We are comfortable as one or the other and being both is hard.

There is a timeline on which to be a fox. There is another to be a hedgehog. You must know yourself and act accordingly.

Bitcoin will be more volatile than gold or houses while doing the same job. Eventually it will be mainstream and the price action will be boring. As long as governments keep printing money the dollar price of coins will be much higher when it settles down. The hedgehogs who thought the world needed a trust-less money outside of government control are wrong. But their investment will be right.