The Common Elements of Rug Pulls and Political Promises

Supply, stories and an audience are all charlatans require. Why do we listen? It's time to take The Sniff Test.

I got a tale to tell

A listen don't cost a dime

And if you believe that we're gonna get along just fine.Snake Oil by Steve Earle

An Unfulfilled Promise

Charles Ponzi did not invent the Ponzi scheme. 40 years earlier it was developed by a fortune teller called Sarah Howe. She was a serial offender.

Howe established the Ladies’ Deposit Company in Boston in 1879. Deposits of between $200 and $1,000 were collected from single ladies without property. Interest was promised at 8% per month. The only way to pay this was with money collected from new customers.

In early 1880, a male reporter at the Boston Herald disguised himself to expose the fraud. The publicity led to a boom in business and it wasn’t until the Boston Daily Advertiser ran a series of exposés that the house of cards collapsed. In April 1881 Howe was sentenced to three years in prison.

On release she repeated the trick, offering 7% per month through The Women’s Bank. This ran till 1887, when Howe fled to Chicago with $50,000 of depositors’ cash. Shortly after, the Ladies Provident Aid was offering 7% per month interest with three months paid upfront.

Forced to flee once more, Howe was arrested in Boston and served another year in prison. Afterwards, she returned to fortune telling and died penniless in 1892. Charles Ponzi was 10 years old.

A Ponzi scheme singles out a section of society and makes them feel special. Unmarried women in late 19th century Boston were ripe for exploitation by a homely type. Victims of schemes want to believe and are driven by an element of greed.

A scam is a promise that isn’t fulfilled. Look closely and they’re everywhere.

Rug Pull

A rug pull is a coin token established for the purpose of absconding with the funds. The creator is usually anonymous and the purpose of the token unclear. There are three types.

The first is when only a few tokens are sold. Scarce supply sends the price rocketing. At this point the rest of the tokens are dumped on the market. The founder reaps a windfall before the prices collapses.

The most common scam is to link a new token with an established one. Speculators might deposit ether in return for a token offering higher rates of interest. Word spreads, the pool expands and the developer removes the ether and disappears.

The Squid Game rug pull used a coding trick. Only the developer’s tokens could be sold. Investors lost around $113 million while the developer gained an estimated $3.3 million.

Crypto is plagued by rug pulls. Many participants revel in the trust-less nature of decentralised finance and declare code is law. Even when the code is used to defraud.

Crypto schemes attract people with cash looking to get rich quick. The pandemic era handouts fuelled the rug pulls, but they continue as financial nihilism grips a generation. Those unable to afford housing and convinced that bailouts mean traditional finance is rigged, look to the margins for salvation. To date, far more money has been made than lost.

Crypto is finance on the edge. Its scams are nothing new and their size underwhelming. The discovery that $7.5 billion the US government set aside for electric vehicle charging stations has resulted in eight being built, shows mainstream scams are alive and well.

Pump and Dump

On the stock market, buying shares and pushing up the price before selling, is known as a pump and dump. Retail financial experts spinning stories about shares may be tempted to do it. Meanwhile, professional investors spend time and money persuading others to talk their book. In an age of trend-following automated trading, simply buying a lot of shares attracts attention.

Trump Media and Technology trades around $50 a share. Few of its shares trade, but the total value of them all is around $9 billion. This is remarkable for a loss making company with first quarter sales of only $770,000. Donald Trump owns around 60% and will be able to sell later this year.

There is no stock market equivalent of the Squid Game scam but lots of companies have restricted voting rights. These keep a family or the bosses in control even as they sell shares to raise money. The rules of the game may be changed by the minority.

UK investors turned their noses up at this 25 years ago and the US became the tech financing capital of the world. Now the same UK money managers ship our pensions to America to buy those companies. The idea that money flows to where the rules are strictest, is a British conceit based on a notion of fair play that never existed.

Roaring Back

The conditions for a rug pull are money and narrative. The more convincing the story, the bigger the bubble and the more truth to the tale, the longer it persists. Rug pulls increase towards the end of credit cycles, when money flows freely.

The film Dumb Money told the story of Keith Gill, known as Roaring Kitty on YouTube and X. He corralled an army of retail investors into buying GameStop shares and bust a hedge fund in the process. Earlier this month the X account was back, posting nothing more than the picture of a gamer. GameStop shares rocketed.

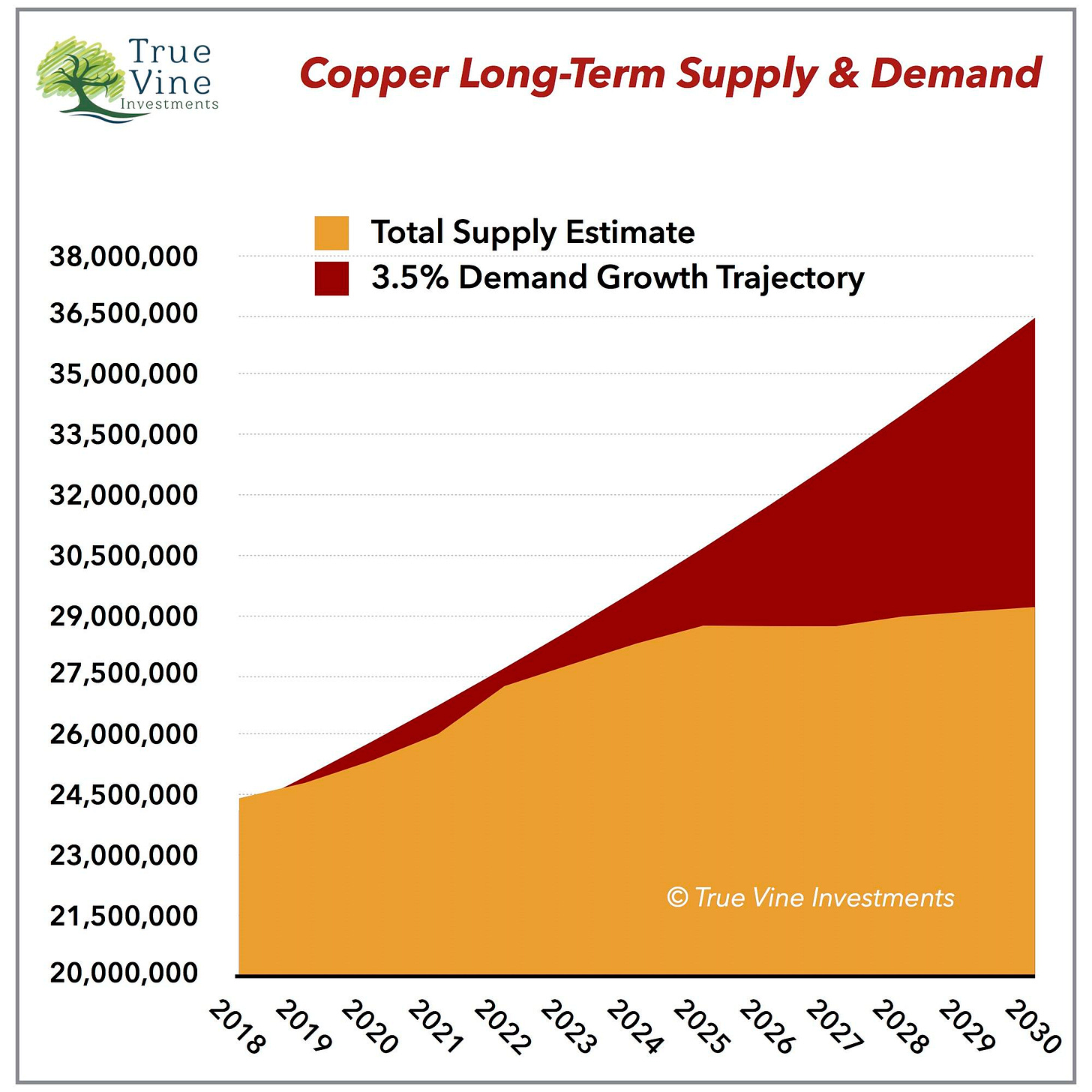

There is no news to support this latest rally, which is petering out. Other narratives have a ring of truth, such as the idea that the copper price reached recent highs due to demand for data centres. Microsoft opens one every third day.

Copper is a key material for sustainability. The IEA forecasts that more than a third of demand will come from clean technology by 2030 in its sustainable future scenario.

The chart illustrates that this not new thinking. Copper matters across the economy, including for property development. China is the largest producer and consumer of the metal and its property market is a mess. Meanwhile those benefiting from the price rise are happy for us to believe it’s AI driven.

There’s plenty of evidence that the AI revolution is for real. Nvidia reported revenue over $26 billion in Q1 2024, up more than 260% from a year earlier. It makes state of the art chips and as companies rush to build AI, they fill Nvidia’s coffers. While credit flows and money supply grows no amount of warnings will burst the bubble. That requires an as yet unknown pin prick.

Elon Musk raised $6 billion for xAI and is now a serious player. This comes with the usual bravado and a claim to be building the world’s largest super computer. Musk now runs five companies, although the share price of the flagship Tesla looks in need of AI fairy dust.

Ben Hunt of Epsilon Theory says Musk’s moves are rug pulls. Tesla owners wait in vain for promised automated driving systems, while Musk moves on to robots and AI. The nature of rug pulls never changes and their frequency accelerates at the end of an economic cycle.

Political Promises

A scam is an unfulfilled promise. Politics is full of those. One reason Rishi Sunak called the election may be that he promised to control inflation and it fell. Politicians cannot control inflation.

Central banks, like the Fed and Bank of England, are supposed to be in control, but either can’t or don’t understand how. In the US, the waves of rising prices were blamed on used cars, then food and now housing. The narrative shifts. The UK uses a different calculation of housing costs, which may have determined Sunak’s timing.

Inflation is a result of more money. No surprise that it took off when massive handouts were given during Covid. Money is still sloshing around and the story keeps changing as to why we’re not back at 2% price rises. Blaming anything other than government largesse is a narrative rug pull.

In the US, Biden promises a subsidy for first-time buyers. This will increase the price of houses one-for-one. When the amount students borrow for college was increased, the cost of tuition at some institutions rose by the same amount a day later.

Whether it’s net zero tax breaks, housing subsidies or reparations for slavery, handouts will be spent and the money go to incumbent companies. Nothing changes, except prices rise.

If you subsidise net zero and at the same time block imports from China, you end up with 8 charging stations for $7.5bn. Buying American and being tough on China are powerful political narratives. In the rug pull part of the cycle that’s more important than outcomes.

People care about the price of housing, fuel and food. The cost of food is weather dependent short term and water dependent long term. Meat is water intensive, but so are nuts if you go vegan. We must all eat fruit and vegetables (but no avocados).

House prices will rise until supply goes up a lot. The reason this doesn’t happen is explained in this piece by

. The unique position of London gives the UK an acute problem. The fragmentation of the finance industry across Europe may be cheered in the shires if it erodes property demand in the capital. There is no sign of it yet.The price of petrol will rise through time because sustainability policies make oil less attractive to extract. Supply is constrained, while demand rises in fast growing parts of the world. The price of energy depends on access to fuel, competition and taxes. Electricity costs around 50 cents a kilowatt hour in Germany and the UK, and under 20 cents in the US. It’s about 8 cents in China. Try relocating industry with those odds.

Media Manipulation

A rug pull requires money and narrative. Another way of saying this is supply and a story. The media equivalent is distribution and news.

Newspapers controlled distribution before the internet. Their stories might reflect the bias of the owner, or offer a balanced view. Readership was secure.

The coming of the internet meant media lost control of distribution. Companies fought back with stories. They doubled down on audience targeting, pushing emotional buttons, and dividing and conquering. The New York Times and the BBC remain relevant but are more divisive.

The availability of digital content on demand split society. The internet may be merely the medium, but manipulating it requires polarising content. Technology is always part of the answer.

They say that ‘Guns don’t kill people, people kill people.’ Well, I think the gun helps. – Eddie Izzard.

Behave as Expected

When critics are rude about a new product they call it a solution in search of a problem. In may ways this describes AI. Its reach is big, broad and non-specific. Large language models consume so much data that AI is required to generate new content for AI to ingest. The machine writes its own narratives.

Hallucinations are a feature of AI rather than a bug. These are false facts presented as truth. The solution is to fine tune a model to do specific tasks.

By educating models with proprietary data and existing processes, power flows to the already powerful. The only private data is in corporate hands. Personal data is public regardless of protections and clicking off cookies.

It’s a familiar script that technology entrenches power. There are scripts for all aspects of society and every element of the economy. They tell us how we are supposed to behave.

Ponzi schemers exploit human herd behaviour. Politicians and companies do the same. Ignoring the script saves you from scammers, but puts you in the crosshairs of the powerful.

Understanding the scripts that we are supposed to live by is the purpose of The Sniff Test.

Recalling the collapse of British and Commonwealth and Coloroll, both of whom collapsed under the weight of leverage as interest rates rose, was soon followed by the book ‘Accounting for Growth’ by P&D analyst Terry Smith which was another takedown of the delusions of bull market corporate management which the late Tony Dye spotted far too early for a UK fund manager to successfully exploit

Seems to me that whilst history may not repeat itself, it does echo loudly and the biggest rug pull of all, as the fiat money system created by central banks approaches its day of reckoning following interest rate rises and something vaguely resembling a move back towards a proper risk premium for money