The risks we take today: from pensions to climate change

We are bombarded with risk warnings, with costs and restrictions that we're told are for our own good. Is this correct? It’s time to take The Sniff Test.

In 1997 I crashed.

I spin across two lanes and land squarely on the grass. A few yards either side and the car bounces off the barriers into the fast lane.

Things happen for a reason. We can describe the physical actions leading to an event with enough precision that the result is inevitable. Physics and chemistry explain all events.

This is determinism.

Things happen for a reason. Years later we look back and draw a line between events and understand the higher process at work. The future is not predicted by mere physics and chemistry.

This is fatalism.

I still drive. I no longer face flash floods in Kuala Lumpur and am more cautious with age, but driving remains risky. Is it my free will to drive?

Warren Buffett hates your pension portfolio

Warren Buffett is one of the world’s wealthiest people. His fortune was made investing insurance premiums. He benefits from the delay between collecting money and paying out claims. His companies understand chance and cash in because people must buy car and buildings insurance.

Buffett takes a few, carefully calculated risks and backs each with a lot of money. He avoids things he does not understand and considers your diversified pension portfolio to be a risky investment. There is no time to understand all those businesses.

But wait, isn’t your portfolio spreading risk and therefore delivering the best results? You are being cautious holding a range of assets, meaning you don’t miss out on good things and are not too exposed to bad. Can you and Buffett both be careful in your investing strategy and reach opposite conclusions about risk?

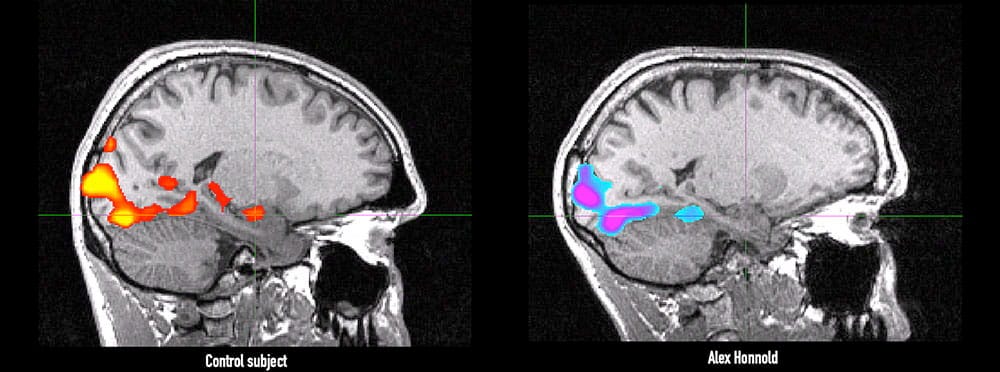

Alex Honnold was the first person to free climb El Capitan, a 3,000 foot vertical wall in Yosemite National Park. A study of his brain reveals that he seeks twice the thrills of the average person, but he is also highly conscientious. According to analysis by Crystal Knows, Buffett is also primarily conscientious.

Conscientiousness is associated with detail and a tendency to over analyse. Honnold spent seven years preparing for his record breaking ascent. He also claims to have trained his brain to be calm and that his apparent fearlessness is not genetic.

Of the four DiSC personality types, conscientiousness, stability and influence are each most common in around 30% of the population. Dominance personalities are the rarest. Such people are receptive to logic, self-assured and easily irritated by dissenting views.

While the three common types either favour stability or people pleasing, which amounts to the same thing, dominance types are driven to win. This may be what makes rich people take the kind of risks in submarines that most of us consider crazy. But it tends to be self-made rich people, as you are unlikely to rise to the top of a giant corporation if you are easily irritated by others.

We know today that while there is a link between the amount of grey matter in your brain and your tendency to take risk, we do not know why and have not identified a unique area of the brain where risk resides. The most comprehensive research to date indicates some genetic risk traits, but favours the view that how and where you grew up are more important. A comfortable life may lead you to making comfortable choices.

What is Your Risk Profile

Risk is synonymous with volatility in financial markets. The most popular measure of risk at company level is VaR, or value at risk. This is a probabilistic measure of the most money that a business will lose on a given day.

When banks blow up they say there was a black swan or six sigma event. The latter refers to the number of standard deviations from normal, which again is probability based. Six sigma suggests one in around 294 thousand, which is once every 800 years, or more excluding weekends. As the world’s first bank was formed in Sienna in 1472, by my reckoning that means no bank should have gone bust yet.

This is the logic of the people presenting you with risk profiles for your pension funds. You might receive a letter in which your retirement income is shown under three scenarios of low, medium and high risk. If you search for four risk profiles, or seven, or some other number, someone will be peddling their version.

The high risk delivers higher income and comes with warnings that this cannot be guaranteed. Low risk is safer, but may not deliver you enough to live on. My guess is most people shoot down the middle.

The most important thing is to avoid a sharp fall in your investments just before you retire. Your provider will move you into safer assets as you get older, which should preserve the value of your pension. The theory is that you take more risk when younger and less when you are old.

A study by ResearchGate looked at demographic factors and risk profile. It concluded that the only factor that does not influence your risk profile is age. Gender, income and wealth are all more important.

How to get rich

Knowledge is uncertain and exists through theories that are the best available to explain the evidence. It seems that a lot of finance is derived from fancy theories that fall flat on their face in the real world. There is simply too much going on for any model to explain and predict consistently.

The idea of black swan events in finance was introduced by Nicholas Nassim Taleb. He noted that until we observed a black swan, all swans were believed to be white. Taleb ridicules those in finance who take risk based on past events and argues that you should always have some protection against the unknown.

Taleb was a trader and ran his book this way. This meant he lost a little each day paying for protection, and made a lot when markets crashed. While a single trader can be positioned like Taleb, a bank cannot.

The banks must make money every day and report growing profits to shareholders every quarter year. Thus they came up with value at risk as a measure of their tolerance. If they all use similar models and things go wrong, then they all go down together. Then the taxpayer bails them out.

Your pension fund doesn’t take a lot of risk. You can chase a bit more return, but they’ll pull you back as you approach retirement. The aim of the industry is to post steady overall results year after year, in order to avoid bad publicity and reassure those approaching retirement age.

This is a cautious approach based on providing comfortable income for as many people as possible. Warren Buffett is not interested in comfortable and prefers to seek the highest, recurring returns. Your pension is cautious in terms of output from the process, while Buffett is cautious in terms of input to the process, and therein lies the difference.

Worry about the riskiness of outcomes and you will comfortable, but not rich. Focus on reducing risk in a process and your upside is unlimited.

The Real Risk of Climate Change

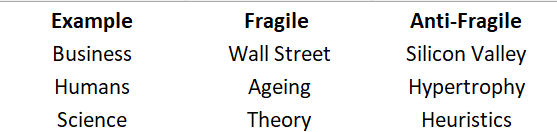

Taleb wrote Antifragile in part as a follow up to The Black Swan. It covers more than finance and includes his theory about why things last. In a nutshell, things survive when they benefit from volatility rather than falling apart.

This is more than experience. We get better by doing things, but we don’t always survive when the stakes are high. Dying is not antifragile.

Wall Street tries to avoid mistakes and limit losses, while Silicon Valley learns from failure. Our bodies become weaker with age, but we can delay this through exercise, where breaking down muscles leads them to grow stronger. Meanwhile in science we have theories that do not survive the evidence, while learning by doing with constant improvement builds better knowledge.

This is important when it comes to the risk of climate change. Tobacco stocks were the best performing industry on the stock market in the 20th century. Fossil fuel companies could be this century’s equivalent, if they restrict investment to a minimum and return cash to investors. Bloomberg Green reports that in recent results the oil majors returned more money to shareholders then they invested.

Around 22% of the global adult population uses tobacco according to the World Health Organisation. This is connected with 8 million deaths a year, but one in five people consider it to be worth the risk. Equally fossil fuels will not go away any time soon and more may be required to provide the energy for a green transition.

The theory says that if you ban fossil fuels people will use something else, but there isn’t anything else right now that can do the job. The only way to replace carbon combustion is to research and develop new technologies such as nuclear fusion, hydrogen, and biofuels. All of them require energy to develop and produce.

The real risk of climate change is that we base political policies on unproven theories, direct science to pet projects rather than leaving it free to experiment, and ban industries rather than adapting them.

Taleb’s view of climate change is that it is uncertain outcome. For him, this means the unknown risk is the one to fear and we should address things like CO2 emissions just in case. He doesn’t trust the models and he likes to be protected. Banning oil in the West will not deliver this.

What is free will

It is not determined or fated that climate change will lead to disaster. There is a path that if unaltered could be disastrous, but we don’t know what will happen in the meantime.

Whether we choose to adapt or backtrack, our actions are constrained by the laws of physics. Historians of the future will look back and conjure theories as to why we chose one path or another. Some will argue it was humanity’s fate, others that it was pre-determined, but here and now, it feels as if we can choose.

Some of us prefer a riskier path. The evidence to date is that this preference is explained by what happens around us, rather than by our genes. This means we are conditioned, but how we live is the result of many actions by many people, making it is impossible to predict in advance.

This gives us free will.

How to address the unknown

Risk means different things to each of us. When the media, or finance industry or government tells us something is risky, they are generalising to an extreme. When investing, you need to know how risk is approximated because those are the rules by which the game is played. But you also need to know that the rules are incomplete and failures will occur. When we bail out the banks nobody learns anything and it will happen again.

We are at risk of the unknown. We can work to change that by gaining knowledge, which we do through theorising, experimentation and criticism. We don’t gain knowledge by banning and stopping doing things.

Most people in the West are concerned but comfortable. They don’t have the desire to be different and the relentless focus of Warren Buffett. They don’t have the conscientious planning and dedication to change of Alex Honnold. Many of us aim to go to university and work for someone else.

This is how it’s always been. Change comes from exception and the willingness to challenge convention. One risk of artificial intelligence is that it magnifies consensus to such a degree that it becomes harder to challenge and progress. This is the opposite of the media frenzy that warns the machines will take over and do what they want.

The people who step outside of convention are risk takers. To most of us this is a step too far. Without them we will have no new knowledge and our fate will be determined.

For any readers who do not know, VIX is an index that represents near term expectations for volatility in the US stock market. The higher it is the greater the belief in sharp price moves, which we might call risk. VIX is known as Wall Street's fear gauge.

When the Allies were planning the post WW2 western economy and proposed the commitment to full employment , the Polish economist Mikhail Kalecki in 1943 said in his paper on full employment, words to the effect that 'yes great idea but there's a problem You will create an inflation hothouse fuelled by wages spiralling as it becomes costless to move from one job to another'

Not only was Kalecki proven correct 30 plus years later as the post war consensus gave away to Thatcherism and the neo liberal reset, but the question is, had the wider population been aware of Kalecki's thoughts, would the trade union movement have been as emboldened as it was to drive their agenda to make Kalecki's point for him ?

Are Black Swan events really so, or just another example of withheld information to either buy time to try and prevent the inevitable, or because all was planned ? The Big Short makes this point very well as Michael Burry saw from circa late 2005/early 2006 that the US housing market was so over leveraged that a rise in Fed rates would trigger a wave of defaults leading to a housing market crash and potentially an economic meltdown. Even he said, 'the information was all there Everyone can see it' Except the usual sources of information (mainstream media) made no mention of it until it was too late

So was Michael Burry a risk taker ? After all he traded on the back of publicly available but not disseminated information and his position only had to remain solvent longer than the market remained irrational ! Were either Buffet or Soros really risk takers or just in a position to respond to publicly available information not disseminated ?

When the so called uneducated (according to the political establishment) masses voted to leave the EU, the shock could be felt far and wide because those usually in possession of all the information, briefly had none as they assumed remain would win. Whether the leave vote was informed or not is open to debate. But what is indubitable is voting turnout at elections is in decline signalling a widespread dissatisfaction with the political establishment and the EU vote was the opportunity to make this point and of course “educated” Richmond et al voted to remain

As Margaret Thatcher alluded, with freedom and knowledge comes responsibility and its been evident since 2016 that the last thing the establishment want is the masses taking risks

Its for our safety after all