The stranglehold of Midwest manufacturing on us all

From assembly lines to stock markets the auto industry defines politics. It's time to take The Sniff Test.

End of an Era.

At least the Chevvy Malibu will outlast Rishi Sunak. General Motors announced that it is the last of the Big 3 US auto makers to abandon the sedan. Rishi announces a general election. GM expects an electric future to be brighter, while Rishi acts before things get gloomy.

Production of the Malibu in Kentucky will be replaced by the electric Bolt. The new car is more expensive, but with subsidies the taxpayer makes up the difference. The challenge is how the car qualifies for them.

Half of the 130,000 Malibus sold last year went to hire fleets. In contrast, 70% of the more popular Toyota Camry and Honda Accord are bought by individuals. Japan conquered the US car market long ago. Yet fewer than 20% of auto sales are cars, as UN manufacturers pivoted to trucks and Sports Utility Vehicles (SUVs).

The declining popularity of cars is down to safety and tax. There is an incentive to buy bigger if everyone else does and the tax breaks for small business favour large vehicles. This increases pollution, even though tax breaks are designed to be green.

Personal Safety

In game theory, the Prisoner’s Dilemma confronts two inmates held apart and questioned. The lowest combined sentence is when both stay silent. Should they both confess they get twice as long behind bars. In two from four scenarios one confesses and the other stays silent. The grass goes free and the hardened con gets a maximum sentence. The lesson is to comply.

If we all bought small cars the roads would be safer with less pollution. This is like two prisoners staying silent. The more people buy SUVs the more likely we are to collide with one. This is like staying silent when your fellow inmate confesses. You lose by not complying.

Collisions with SUVs hurt pedestrians most. From 2012-21, walking deaths in the US caused by SUVs rose 120% compared with 26% for cars.

There are a number of reasons for these accidents. 19% of drivers were over the limit, as were 31% of pedestrians, albeit there is no blood alcohol limit on walking. More than two thirds of fatalities occurred on roads without sidewalks. There is an increasing trend for deaths caused by distracted drivers, meaning those on their phone. This is more common with 18-34 year olds.

You are 50% more likely to die in a road accident in the US than in Canada, Western Europe, Australia or Japan. Yet Americans drive twice as much as people in France or Germany and even more compared to the UK. It’s a big country and by mile driven it is safer.

There are 1.26 US deaths per 100 million miles driven. That adds up with over 5 trillion driven every year. That’s about a billion times around the coast of Mainland Britain.

Whatever the numbers, it’s safer to have an SUV than not. That’s what game theory tell us and it plays out for real.

Tax Breaks for Pollution

The best selling vehicles in the US are Ford, Chevrolet and RAM pickups. The best selling non truck is Toyota’s RAV4 SUV. Tax incentives are a big reason for this.

Small businesses owners who head a household get a big break for buying a large vehicle. Trucks over 6,000 pounds get a $25,000 tax break and large SUVs may be entirely written off. 6,000 pounds is 2.7 metric tonnes, or 3 short tons.

99.9% of US businesses are small. In over 80% the owner works alone. Most make under $225,000 meaning they qualify for the tax break. As a result American autos are getting bigger. This means more materials to build them, more fuel to power them and more pollution from driving them.

Plug in electric vehicles (EVs) qualify for a $7,500 tax break. This requires the critical minerals to build them and their batteries to come from the US or friendly countries. The subsidy may be put towards a larger car than people would otherwise afford. This means more pollution.

After the introduction of catalytic converters, the primary source of air pollution is fine particles. To the extent cars contribute to this, it’s from brake, tyre and road wear rather than exhaust emissions. The heavier the car the more friction and hence fine particle pollution.

Not Playing Fair

Companies manufacture in the lowest cost country. The only reasons why corporate America rebuilds domestic capacity are subsidies and taxes on foreign goods. If subsidies are for going green, they will. That gets expensive.

It costs more to dig a tonne of an otherwise identical mineral in the US than overseas, due to sustainability requirements. Lazard estimates America is 100% dependent on importing 12 of the 50 most critical minerals and at least 50% dependent on over 30 more. Until domestic production takes off, a blind eye is turned to unsustainable extraction.

It takes more than 15 years to develop a mine. It takes a few more to reach capacity. This makes 2030 Net Zero pledges look impossible given the pollution from extracting raw materials. 2050 is a stretch.

Then there is the problem of China owning a lot of the minerals. Ford made an investment in an Indonesian mine with a 26% Chinese shareholder. That disqualifies all the minerals from counting towards the requirements for tax breaks on electric vehicles. Hence the auto lobby is hard at work seeking exemptions from the rules.

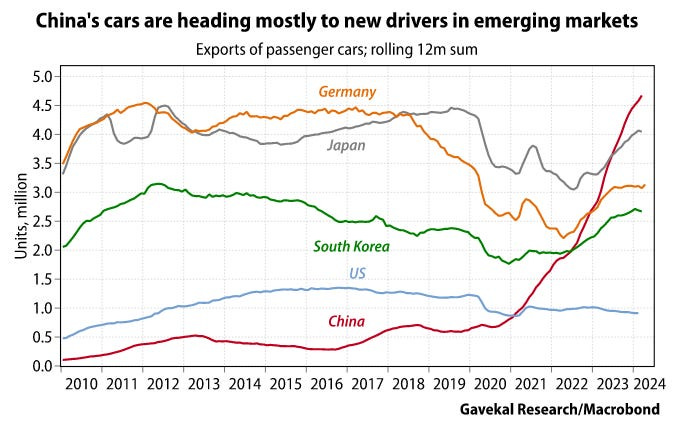

Meanwhile China pumps out electric vehicles and has become the world’s largest exporter of cars.

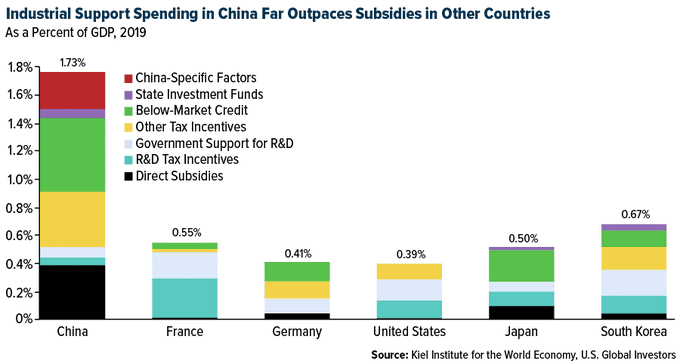

The Chinese government subsidises 99% of companies listed on its stock markets, according to the Kiel Policy Brief that informs an EU investigation into the matter. On its most conservative estimate, subsidies account for 1.7% of the Chinese economy.

Everybody subsidises but China does it too much. When complaints are raised, it must look to Beijing like the West makes the rules and doesn’t like the consequences.

Battery electric vehicles, wind turbines and railway rolling stock receive the heaviest subsidies. These are for both manufacturing and purchasing. Chinese EVs are far cheaper than Western equivalents, which is the main reason BYD overtook Tesla as the largest EV manufacturer.

Critical industries receive other favours. These include government purchasing, preferential access to raw materials, forced technology transfers from foreign firms, and a bureaucracy favouring domestic suppliers. Again in Beijing, it seems rich the EU whining given its substantial non-tariff barriers to trade.

The Kiel brief recommends the EU imposes restrictions on Chinese electric vehicles. The result is likely to be the same as for US tariffs. This is to divert Chinese goods to third countries, such as Mexico and Vietnam, which earn a commission for shipping them to the US.

China has a massive incentive to flood the market with cheap goods. It wants changes to international exchange rates. The US wants to park trade until after the election, but may not be able.

The Measure that Matters

Picking my way through the litter of electric bikes, as Lycra-clad commuters whizz by, it’s easy to see the future as if a metropolitan politician. Speed limits, congestion zones and battery powered transport rebuild our cities into mini-communities.

Electrified public transport takes us on longer trips. Rezoned commercial property solves the housing shortage. Pedestrians stroll to artisan markets.

While politicians dream of electric city transport, the battle for the car market continues in the global south. This is where demand will boom, first for cheap cars and then for clean. China and Japan are slugging it out.

The main weapon is the exchange rate. Cars are software in a metal box but the technology is commonplace. Price is the issue and the exchange rate plays a big part in what car manufacturers charge.

Meanwhile, the percentage points gap between interest rates in the US and Japan attracts yen into dollars. China holds its currency stable against the dollar and hence it appreciates against the yen. The policy is to stabilise the domestic price of food and fuel paid for in dollars. Inflation is revolutionary.

Japan also imports these goods, but a debt-laden ageing population is a deflationary compensation. It’s also less susceptible to revolt. Exports are its economic life blood and a cheaper yen is critical in the battle with Beijing.

China is trying to pivot to a Western, consumption-led economy. But this is incompatible with state control and the heavy subsidies for industry and pet projects. A predilection for property has led to massive over supply. We’ve reached the point that whenever the central state releases funds, its offset by local authorities drawing in their horns.

Hence, exporting remains China’s route to prosperity. The world beyond the West becomes more attractive given its size and growth and sanctions elsewhere. These markets have a Western veneer of Gucci handbags and Four Seasons hotels, but cars, machinery and manufacturing are what matters.

Beijing needs the yen to stop falling. Tokyo thinks it is cheap enough. But traders move markets the other way, forcing China, Japan and the US into action.

Three Body Problem

The solution seems to be to raise Japanese interest rates. But after decades of holding them down, the Bank of Japan owns more than half of the bond market. Higher rates mean lower bond prices.

calculates Japanese losses of $1 trillion with rates at US levels. The Bank of Japan has a little over $30 billion of capital. It would be wiped out by higher interest rates.Japan is the biggest foreign owner of US debt. It might sell it and buy yen to bring the money home. This would transfer the problem to the US. This is bad politics when you need to buy guns and butter from somewhere.

Japan could mandate its banks and pension funds to buy and hold its government debt. There are no losses if they never sell. The Bank of England does something similar to stuff our pensions with UK debt.

The problem is this ties up money on miserable yields for years. The economy is stifled. Rates are low at a time an ageing population requires its savings. Bad politics.

With no good options in the US and China, the ball is in China’s court. It may devalue the yuan and flood the world with cheap goods. Domestic inflation would soar but a short, sharp shock maybe be better than drawn out pain.

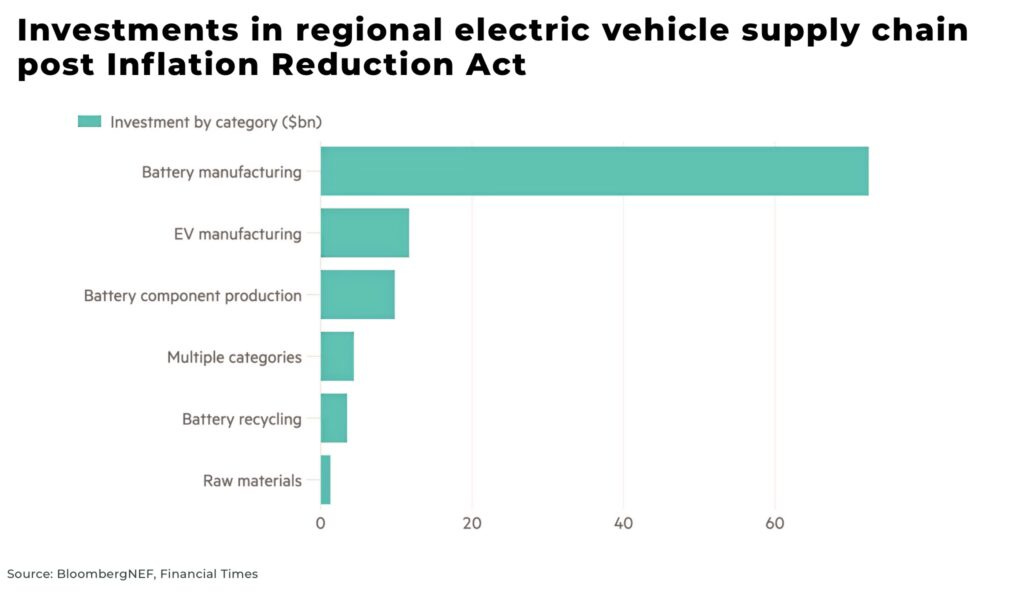

If China devalues, US corporations will say they cannot compete. The reshoring of US manufacturing would grind to a halt and the political noise would be deafening. Even worse, the stock market might fall in an election year. The chart shows the billions of dollars being pumped into green manufacturing in the US.

Arthur suggests an alterative. The fallout from the Global Financial Crisis was managed in part by central bank swap lines. Rich countries lend money to poorer ones to tide them over. This has become a staple of the global financial system.

Swap lines are behind the scenes and hence politically expedient. They are temporary fixes while the election is in November. It works as follows.

The US gives Japan a trillion dollars. Japan gives the US the equivalent in yen. The US does nothing, while Japan sells the dollars driving down price. The yen recovers, inflating the trillion dollars worth the US holds.

As a result, there are a trillion more dollars in the world. Investors recycle these into financial assets. Stock markets rally ahead of the election.

It’s Your Move

The battle for the car was lost in the US years ago. But the Midwest still manufactures and is on a political knife edge. If it looks like the market for trucks, SUVs and EVs is lost, then so is the election. This encourages auto companies to scream for subsidies and exemptions from the sanctions regime.

China can turn up the pressure with a competitive devaluation. The point where the benefits outweigh the risks approaches. Yellen visits Beijing to be told as much. This game is not theory and the ball is back in the US court.