What Populists are Getting Wrong Again

Why short-sighted revenue grabs destroy investment, productivity and trust in government. It's time to take The Sniff Test.

Today’s article is about tariffs and taxes. If that’s not your bag, please scroll down and help choose what future Sniff Tests are about.

A Brief History of US Tariffs

Last week the US Intelligence Community published its Annual Threat Assessment. Top of the list is President Xi’s “great rejuvenation of the Chinese nation”. The US fears China’s expanding influence, intervention in world affairs, and increasing capacity to offset American threats. China unites left and right in America unlike any other issue. Can this justify tariffs on the world?

China gets around trade restrictions by sending goods through third countries, including Mexico and Vietnam. Hence the case for tariffs on these countries. Yet this argument does not stretch to America’s NATO allies. There must be a bigger reason to believe tariffs are productive policy.

The three-pronged economic ambition of the Trump administration is to bring down oil prices, interest rates and the dollar. It is achieving these aims, despite expectations that tariffs would strengthen the currency. This may yet happen, but the rush to buy foreign goods before tariffs hit, and a wave of investors taking money out of the US, had the initial effect of weakening the dollar.

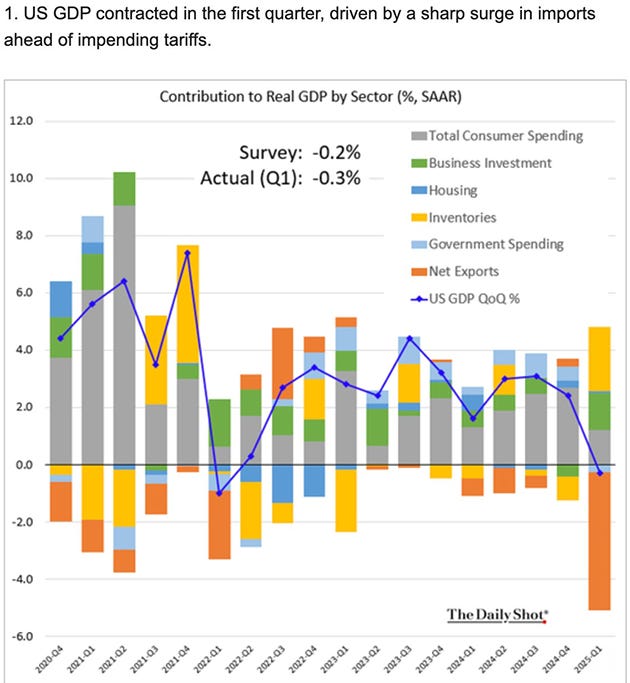

The extent of buying of imported goods is shown in this chart:

Net exports are in orange. Below the line means more imports than exports, which is the usual state of affairs in America. This reduces gross domestic product, a measure of the size of the economy. Trump’s tariff champions believe that if they reduce the negative orange bar they will increase US economic growth. If only it were that simple.

Note the size of the grey bars in the chart. This is the impact of consumption, which is the main driver of the US (and UK) economy. A lot of consumption goods are imported, especially from China, and higher costs will hit consumers and economic growth.

The yellow bars are inventories, or the stock of goods and raw materials that companies keep. Buying more increases growth, which companies usually do when they are optimistic. Running down stocks signals an expected slowdown. The first quarter was different, because increasing inventories were in anticipation of overseas goods becoming more expensive.

The US has history with tariffs. Its revolution kicked off over a tariff on tea. It built industrial strength behind a tariff wall at the end of the 19th century. It then tried the same trick in response to the 1929 stock market crash under the Smoot-Hawley Act.

Smoot and Hawley were ageing congressmen determined to preserve an old way of life. By the 1930s, America was the foremost industrial power and its competitors were devastated by war. The congressmen failed to grasp that without exports to the US, Europe could not repay its loans to America. Reciprocal tariffs plunged the Western world into the Great Depression. Smoot and Hawley’s legacy was that Congress abandoned its right to set trade policy to the President. Should Trump mess up enough, Congress may take it back.

The True Cost of Upfront Taxes

The challenge in Congress is the number of votes required to pass legislation. Members horse-trade over parochial interests and lose sight of the bigger picture. The Washington bubble is no place to learn about the struggles of the average citizen.

OTAS Technologies was bought in 2017. The then Chief Operating Officer of Liquidnet in London laughed when he saw my day job. I’d spend a couple of hours each morning ensuring there was enough cash to keep OTAS going. He could not comprehend this. In big businesses things just happen. Executives are shielded from the little tasks required to keep the lights on in any company.

Small businesses provide up to three quarters of all job openings. Many of them rely on imports. They buy machines to manufacture goods, distribute foreign products, and use materials the country does not possess. A tariff is an upfront tax on doing business. Unlike tax on income or profits, it is paid before anything has been earned.

The higher your upfront costs, the more capital you need to operate. Big businesses have easy access to banks and investors to raise money. Small businesses find it harder. Tariffs are a bad idea because they crush the most dynamic part of the economy. Why then do people support them?

Tariffs appear to be a magic elixir. Whatever the problem, the answer is a tariff. It raises revenue, it protects domestic industry, it punishes foreigners and forces them to negotiate. Barriers are erected to create trade blocs, such as the British Empire, the EU, and the United States–Mexico–Canada Agreement. Of course, a tariff cannot do all these things at once.

The US learned from the errors of the 1930s and encouraged free trade with Western Europe after World War Two. Rebuilding the continent created a market for US products and a bulwark against Soviet power. Europe was a friend.

The olive branch was extended to other economies. Japan and South Korea signed up. Then came the threat to US dominance. It no longer serves US interests to allow China to develop unchecked. It makes no sense to be reliant on it for shipbuilding and pharmaceuticals. Safeguarding strategic industries is the strongest case for tariffs.

Trump argues tariffs raise revenues, but for what? The argument in the UK in the early 20th century was tariffs would fund emerging social welfare without raising income taxes. Today the US has both income tax and a welfare net and may need a bigger net to catch the fallout from failing small businesses. It is not clear whether tariffs will raise income or costs.

Then there is the question of who pays the tariffs. When there is lots of competition, overseas suppliers pay. If there is little, companies try and pass the cost onto consumers. Small businesses are often caught in a trap, where they buy from one overseas supplier and sell against many competitors. They must swallow the tariffs and don’t have the cash.

Trump calls tariffs reciprocal. He wants to strike trade deals. If these remove tariffs then the safeguarding and revenue arguments go out of the window. Tariffs cannot solve all problems at once.

I read a lot of negotiating theory when preparing online courses for small business owners. The advice, from expert hostage negotiators to international diplomats, is to uncover motivations and ensure people have a positive story to take from talks. Threatening people is never a recommendation. Few take Trump’s Art of the Deal seriously.

Tariffs suited monarchs and landed gentry as a means of raising taxes that the masses would pay. The cash flow constraints on average citizens were of no concern. Trump’s brutal attempt to rebalance the economy will fail. The UK alternative runs the same risk.

The Fear of Reform

Last week Reform emerged victorious from local elections in the UK. These votes are a litmus test for government and allow a course correction before the important business of general elections. Labour knows that cutting the winter fuel allowance was unpopular and a number of its MPs want to get back to the party’s core redistribution agenda. This means revisiting wealth taxes.

These are applied to assets, such as property, savings and investments. They are small but common in Europe and council tax is a wealth tax. It is paid on the value of a property rather than income from it. Wealth taxes, like tariffs, are upfront taxes.

Politicians aim at billionaires. The problem is they walk away. The taxes then trickle down the pyramid till they land on people who cannot move. Salaried, middle class home owners for example.

Some want the middle classes to pay more tax. So what if they run down savings, re-mortgage the home, or eat into their inheritance. It’s about time they found out how the other half lived. This is the politics of envy and saps a country’s ability to compete and grow.

Rising house prices are the primary source of retirement savings for the majority of the UK population. Taxing expensive homes would be simple, but paying the taxes is not. It costs money to live in a house and there is no income from it. How would you pay a 2% tax on the value of your home? Reduce savings, or sell some shares?

Accumulated wealth is how a country invests. Bank deposits become loans and investments fund companies. Taxing wealth reduces the money available to fund innovation and saps an economy’s ability to compete.

The End of an Era

The Sniff Test is the search for what follows the post-war era. This began with the creation of big government and bore witness to an unprecedented wealth creation and growth of the middle classes. It may end with their destruction.

There will always be people who have more and those with less. Redistributing wealth does not solve this. Instead it takes money that might fund the future and gives it to others to spend today.

There was a giant spending experiment during Covid. The result was short-term growth, inflation and the debt governments now fret about. Amazon was the big beneficiary. Redistributed middle class wealth ends up in the pockets of asset owners. The top 1% owns half the UK stock market, the top 10% owns 90%, and the figures are higher in the US.

Today’s champions of wealth taxes are as naïve as Smoot and Hawley. You cannot spend your way to being middle class. Pretending otherwise will drive more support for Reform.

Editorial Note:

There is a lot happening that I could write about. I would love to hear what you are most interested to read. Please reply to The Sniff Test email, or better still comment on the Substack post, to let me know which of these topics is high on your agenda.

The War in Ukraine

It is 18 months since I last wrote about Ukraine. I argued that the war was over bar the killing, because we had reached a stalemate. While depressing, that view has stood up well. We’ve now reached the point where those most eager to fight are least able to afford it. What happens next?

How to Handle Reform

The Conservatives face the most immediate challenge from the rise of Reform, which encourages Labour to allow it to happen. Yet the ascent of the AfD in Germany shows that at some point the radical right eats into the socialist vote. The response in Germany is the absolute worst one imaginable and threatens its democracy. Could Britain go the same way?

Is Net Zero Causing Power Cuts

I feared that the true cause of the blackouts across Europe would be hushed up in the same way as the Covid lab leak. Thankfully there is an honest discourse. The problem is less renewable power and more the policy around it. This starts with top-down unachievable net zero goals and ends in the workings of the electric grid. How do we make cheap, clean fuel effective?

Is Democracy Over?

A reader sent me a picture of the Labour Shadow Cabinet from 10 years ago. It consisted of people who had been booted from office and many of them are back in power today. If we are governed by a political class on both left and right, how do we kick the underperformers out? As the ability to do this is the definition of democracy, has our way of government run its course?

Excellent article to read so many thanks

I disagree slightly regarding the avoidance of trade restrictions via third countries not applying to America's allies based on the prima facie summary of the EU trade deals with Mexico and Canada which have resulted in structural deficits for both Mexico and Canada, and the USMCA which resulted in structural surpluses for both of them with the US.

Claudia Sheinbaum may have all but admitted this by announcing a framework agreement with the Trump administration that protected "goods made in Mexico" So I think there is enough evidence to support a view that the EU is well versed in this model not least because the tariffs Europe were allowed to apply on auto manufacturing as part of the Marshall Plan post WW2 still apply to this day, and the EU especially applies harsh tariffs on its bi lateral arrangements with South America and Africa, again happily taking the raw materials but erecting a high tariff wall against finished goods coming into Europe.

Europe's big problem is that its export generated wealth wasn't invested into infrastructure or used to balance the broader economy to the consumer. Instead they bought trillions of notional dollars of US Treasuries and it appears the UK was doing the same in alignment even post the 2016 Brexit vote and the 2020 Brexit legislation and continued as the Fed began raising rates.

So there seems to me to be a reasonable argument that the assault on the middle class began in Europe and the UK, and the effect of Trump's tariffs, which could be argued to level the playing field, exposes deep rooted failures of UK and EU leadership as the US started to shift its own model away from Europe which arguably began when Trump 1.0 appointed Jerome Powell in 2017. Like a spuernova, I suspect Western governments continue to balloon a la Mr Creosote before collapsing under the weight of unserviceable debts and political vacuum

Some thoughts re your topics for discussion

1) Ukraine : Why are the EU and UK so desperate to continue a war they cannot win against a re-ascendant power whose military capability seems to have been hopelessly underestimated by NATO ? EU Foreign Affairs Commissioner Kaja Kallas openly expressed the old Mackinderist view that Russia should be broken up . I'd say at this point, the break up of the EU is more likely as popular unrest spreads

2) Reform : I agree with the Pete North summary which is that until Reform come up with a coherent workable alternative agenda, they will not replace the governing establishment and, like the SDP in the 1980s, probably end up either merging or disintegrating

3) Net Zero : If ever one agenda epitomised a government's ability to squander billions it does not have on useless boondoggles no one wants, it has to be everything to date proposed by Ed Miliband including the £22bn carbon capture unit in Runcorn. Combined with turning vast acreage of farmland into solar panelled eyesores, how much food production do they intend to destroy and food price inflation create before conceding it does not work ?

4) Democracy : No argument here It can be argued that the people of the UK have been voting for change ever since Maastricht was pushed through by the Major government, and whatever manifesto they voted for, they got more of the same drive to European union regardless. This was exposed especially in the Johnson government which had no idea how to process Brexit beyond turning into the overnight event it never was. This only changes when a manifesto becomes binding on the party leading a government with perhaps extension of the electorate power to remove their representatives who fail to deliver what they promise