Thinking the Unthinkable

Does society have intractable problems? Or is our only problem a lack of imagination? It's time to take The Sniff Test.

A Jobs Worth

In 1997 Steve Jobs returned to Apple 12 years after being ousted by the board. The company was losing $1 billion a year and time was running out. Jobs met with the product teams to find out what was happening and proposed a simple solution. Do less.

The next year Apple made over $300 million profit. What is obvious in hindsight was invisible at the time. Or people didn’t feel able to speak up.

Imagine walking into the UK’s National Health Service and doing something similar. Cut back on what’s provided for free. Do 90% of diagnosis with AI. Many people have tried and failed to rein in the NHS. The problem is not imagining what it could be. It’s imagining how to get people to do it.

The Professional Pessimists

There is a long line of professional pessimists pumping nonsense about the risks to humanity. The Astronomer Royal, Martin Rees, estimated in 2003 there was a 50% chance of civilisation collapsing this century. His reward was to be made Master of Trinity College Cambridge and President of the Royal Society. Even if he’s around in 76 years to see we’re still here (he’s 81), he’d say “I only said 50:50”.

Society has big issues to tackle but few threaten civilisation. Asteroid strikes, environmental damage and enslavement by machines are the mega threats. Thereafter ageing populations, unequal wealth distribution, housing shortages, broken banks, record debts, immigration and access to education and healthcare should vex our politicians. But these issues won’t be the end of civilisation. They need political courage to solve. Where will it come from?

There are various theories of grand cycles that point to the end of this decade as when things come to a head. At that point a younger generation of politicians will rebuild society in ways inconceivable today. Maybe it takes a crisis or two to bring about change. But just because we cannot imagine how the current system solves our problems doesn’t mean they don’t get solved. There will be new systems.

Demographics is Destiny

The global birth rate is reducing. Analysts at HSBC predict that on current trends the world’s population will peak during the fourth decade of this century. Demographics works slowly but bakes in the future. Fewer mothers of child-bearing age mean fewer babies 30 years from now.

Our economy is based on a growing population. We measure growth by the number of workers multiplied by their productivity. Fewer workers means a smaller economy unless we become much more productive. That’s a big burden on machine intelligence, assuming it doesn’t enslave us first.

Then there are our public services, paid for from taxes and increasingly debts. Fewer workers means less tax, while more retirees demand services and pensions, in return for working in mid-life. The system was not set-up assuming fewer young people and more old, but that is what’s happening. Debts continue to mount far faster than they can be repaid.

I’ve had a number of insightful conversations about debt since starting The Sniff Test. There is an argument that my debt is your wealth and things even out. As my spending is your income, raising debt for me to spend, would be good for your business and your savings. I see this. But at the individual level, debt is a burden. It’s individuals who vote and who combine to start revolutions.

Do fewer humans solve the climate crisis? Unlikely, when we are building many more supercomputers to do the work and must power them and keep them cool. Green energy is only green when it’s operating – building the hardware is highly polluting. We are baking in the need for clean energy by generating it, among many other causes of climate change. A hundred years from now we’ll be green or living in northern Canada and Siberia. Or both.

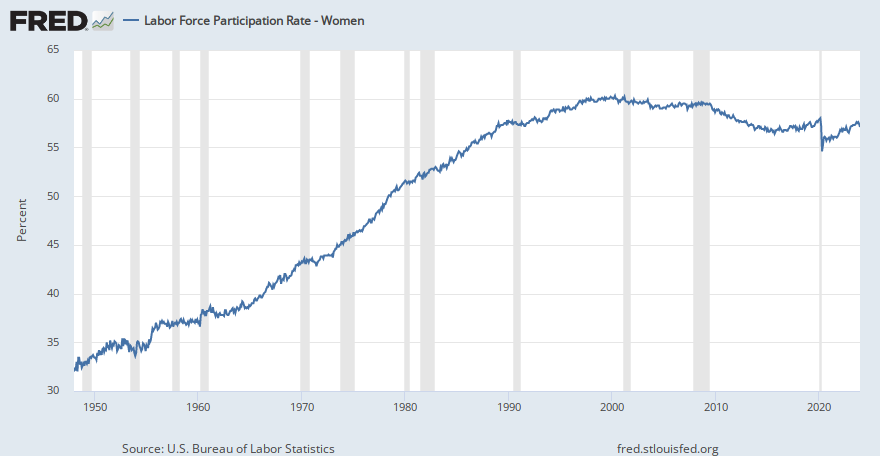

Why is the birth rate falling? In the West it’s easy to blame high house prices and the cost of college putting younger couples off reproducing. An alternative explanation is that we are seeing the consequences of this chart.

More women work. The percentage of young US females with a job doubled between the mid-sixties and mid-nineties. Baby girls who weren’t born during the Clinton administration would be of child bearing age today.

Even if in the next decade people procreate more often, the trend in taxpayers – assuming the way taxes are raised today – wouldn’t change until the second half of the century.

The most likely way people will have larger families in future is if we fix our economic problems. These are interlinked but there is one glaring way they stand out.

Rich Getting Richer

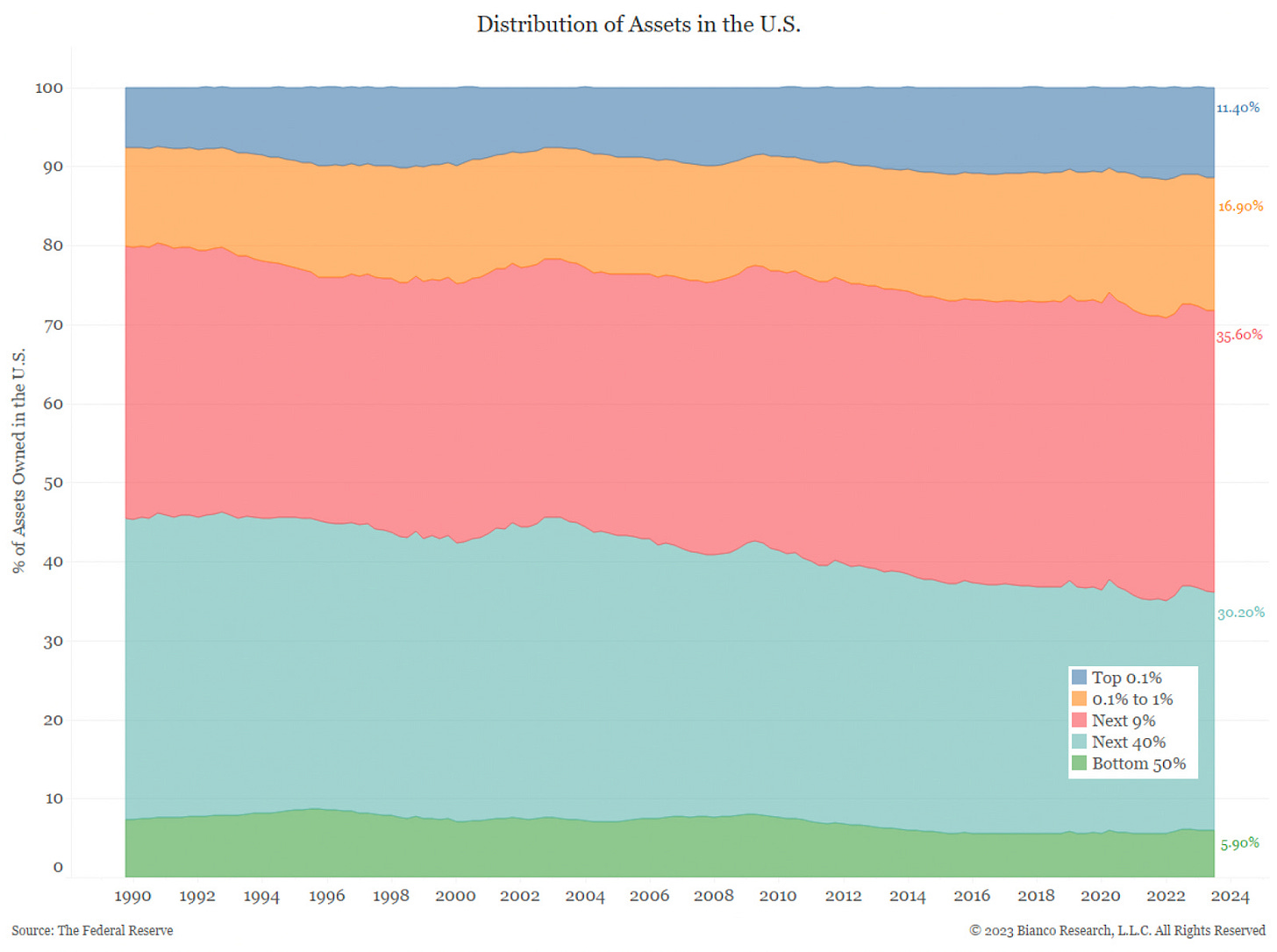

Uneven wealth distribution is pronounced in the US. Here are two charts from Federal Reserve numbers to hammer this home. The first shows one in ten people own two-thirds of the wealth.

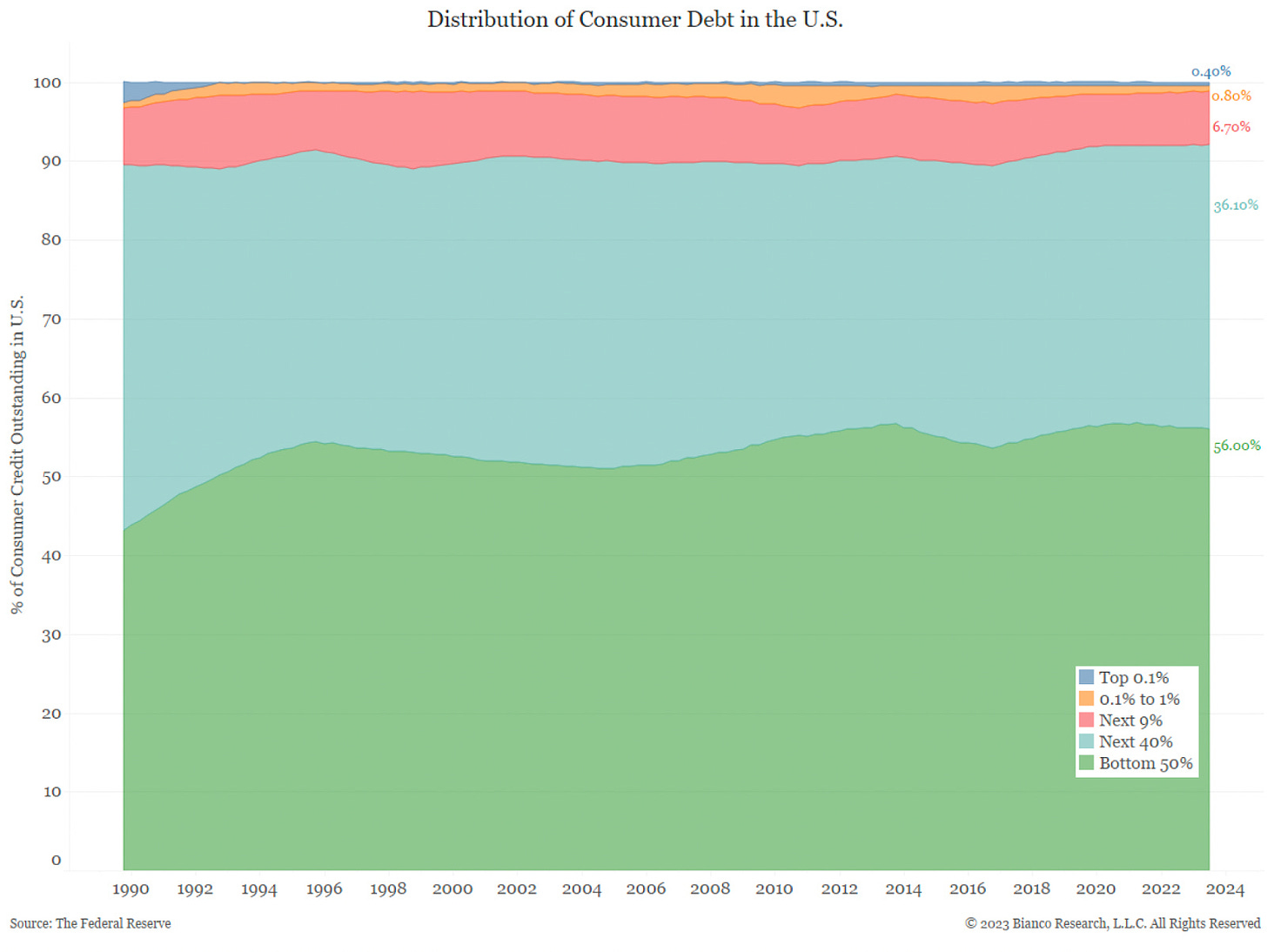

Nine out of ten people don’t have nothing. They have over 90% of consumer debt.

While in aggregate more debt may not matter and could be argued a good thing, its distribution does matter. If most people struggle to pay the mortgage, car loan and credit card, and may never pay the student loan, there is little comfort knowing their debt equals other people’s wealth.

Every now and then, such as in the crisis of 2008, the world’s investors puke their debt holdings and the banks go bust. That crisis was solved by nationalising the debt and now the banks are stuffed with government bonds. If they had to sell them today they’d be bust again. This isn’t resolved until interest rates on 10-year bonds fall below 3%.

The trouble is that low interest rates break the pension funds. They assume they’ll earn 7 or 8% a year and that’s tough when interest rates are below 3%. Share prices have to rise a lot faster to compensate, which means company earnings have to accelerate. That’s harder if fewer people equals less growth and more taxes. What a pickle.

Trust Me Money

There’s debate in the crypto community about how many people use Bitcoin. Adoption is growing faster than that of the internet back in the day on some measures. Even so, the number of users is tiny compared to the world population. Part of the problem is knowing what Bitcoin is for.

Bitcoin could become the means of transferring money. The payments industry, led by Visa, Mastercard and PayPal with a long tail of other players, is worth $8 trillion. The world pays around $2 trillion a year to move money around according to Brian Estes of Off the Chain Capital. Using Bitcoin could save 99% of those fees. Valued at the same size as today’s payments industry, bitcoins would be worth $380,000 each. They’re around $40,000 today.

Banks share in the payments bonanza and the bigger ones make a fortune trading the big currency exchanges required in international deals. A lot of this trading income would disappear with the transparency of a blockchain. Banks are very much opposed to using Bitcoin, so how might that change?

Central banks, such as the Fed and the ECB, could use them to settle their debts. This is a threat to the dollar system, but in a polarised world countries could insist on trust-less means of moving money. It’s hard to imagine now but that does not mean it won’t happen, especially if there is an international crisis in the next decade.

The first step to this would be central banks owning bitcoins. Currently they use gold as part of a diversification strategy. The gold market is worth $12 trillion. That’s a ratio of 60 to 1 for the amount of gold above ground to the new supply dug up each year.

There are 58 bitcoins for each new 1 mined. Every four years this ratio halves so will jump to close to 120:1 at the next halving in April. The crypto bros salivate over bitcoin replacing gold and being worth twice as much. That’s $1,140,000 per coin.

So what – made up numbers. We have a pension problem because we need lower interest rates to ease debt burdens. But government debt is pension fund wealth. Either the banks or the pensions are bust.

Using Bitcoin a lot more would reduce the importance of banks and the significance of them going bust. Investing in bitcoins that were being used a lot more would improve the returns for pension funds. Estes estimates that an allocation of under 5% of funds to bitcoin would add 2% points of annual performance to pensions. That could make them profitable even with low interest rates.

It's hard to imagine a world without banks. But humans have operated without them. The evolution of money over millennia was shells, gold, coins, notes, bank credit and Bitcoin. Bank credit was enabled by the Medici’s adoption of double entry ledgers. The power lies with the person controlling the ledger. Bitcoin is a universal accounting ledger accessible to all and owned by none.

The US abandoned the gold system in 1971. Our trust-me money is an experiment entering its 53rd year. That’s not long. The primary consequence is 90% of people having 95% of the debt and 35% of the assets. In a dictatorship that’s a worry. In a democracy it can be a more immediate problem.

Trapped by Medici

Society has some serious problems. The good news is that they are of our own making, which means the solutions are as well. They may be unimaginable to most of us but anything to do with progress is. Somewhere out there is the Millennial generation of politicians, comfortable with crypto, sold on sustainability and building their base.

Why will Boomers vote for them? By 2028 the infirmities of much of their generation will be prohibitive and our issues intensified by four more years of status quo. Gen-X politicians, and in the UK those schooled in Blair’s media politics and focus groups, fiddle round the edges. Bigger visions will be demanded and supplied.

Debt may not be a bad thing overall but if it’s an unequal thing there is a problem. A future with fewer workers and more machines makes it harder to raise taxes because the machines could be anywhere. What if they’re in space?

Tax would be raised on goods coming in and out of a country – like the old days – and when you bought something - like sales tax and VAT. If your income is a handout from the government, as a state pension or minimum guaranteed income, there’s no gain taxing it. Private pensions and earnings are different and income tax probably won’t disappear.

Our society bribes poorer people with government services ostensibly paid for by the rich. But when the services are funded by debt, this adds to the wealth of the rich. The rich get richer, requiring more services to bribe the rest and the wheel turns.

I am imagining a society where this stops. Where you pay to collect Calpol from Accident and Emergency rather than seeing it as your right. Where both your health diagnosis and core education are supplied by machines. The cost of technology falls through time and healthcare and education become deflationary not inflationary.

Interest rates will fall. Pensions will need an overhaul – as hot a political potato as healthcare – or an alternative source of returns. Digital assets could provide that.

Of course, bitcoin’s gain would be at the expense of gold, banks and financial intermediaries. These are owned by pension funds today. We’re back trapped in the status quo, where one person’s gain is another one’s loss. The Medici’s ledger is the end of progress.

But imagine if it weren’t.

Editorial note: I use capitalised “Bitcoin” to refer to the blockchain on which uncapitalised “bitcoins” function. This is pedantry, but in case you were wondering.