Death Duty Dilemmas

Inheritance tax is alternatively an outrage, an opportunity or an irrelevance

50 UK MPs campaign for an end to inheritance tax, which is among the world’s highest. Are they justified and will enough people take notice? It’s time to take The Sniff Test.

Is inheritance tax the death tax that robs a legacy, or the Paris Hilton tax that levels up society? Your answer depends on your political philosophy, if you have such a thing, and whether your foundational thinking starts with the rights of individuals in practice or in principle. Is the role of the state to protect individuals from others, including an overreaching government. Or is it to provide a standard of living that we all would find acceptable, and includes protecting individuals from themselves.

The Telegraph has joined the campaign to abolish inheritance tax, but is not debating the rights of individuals, given the complications caused by death. Rather it uses anecdotes of quirky outcomes, which arise on the edge of any law. We meet the co-habiting sisters, where the one who lives longest will be forced to sell the family home, and hear from ex-pats who claim they would happily pay all UK taxes, except inheritance.

Ranged against them are the iconoclasts of The Guardian, which in 2016 backed a call to abolish trusts, an ancient ruse to avoid arbitrary seizure of property dating from the Crusades. Here, inheritance tax is a matter of social justice, but again anecdote serves best to illustrate. The annual amount raised from inheritance could have doubled when the previous Duke of Westminster died, had his assets not been hidden in a trust.

The first part of this essay chews over these issues, while the second, at the request of a reader, considers acceptable means of avoiding inheritance tax. Thank you for the suggestion and do add a comment on Substack with issues that would benefit from The Sniff Test.

Napoleon’s Lasting Legacy

A form of inheritance tax (IHT) dates back to 1694 when stamp duty was introduced on the wills of the dead. This was a century before the first income tax was raised to fight Napoleon, while VAT and Capital Gains Tax are 20th Century novelties. In a nation where precedent is paramount, it is hard to argue that taxing the transfer of assets on death is unwarranted.

The main objection to IHT is that it is double taxation, because it is a levy on things bought with money that was already taxed. Two bites of the cherry for the government. VAT could be considered similarly, because you pay it on goods and services paid for with taxed income.

On this basis, IHT should have been abolished once income tax was introduced, but The Little Corporal was not waiting for the English parliament to debate fairness. By the time he was defeated at Waterloo, 17 years had passed and the taxation of both income and asset transfers was entrenched.

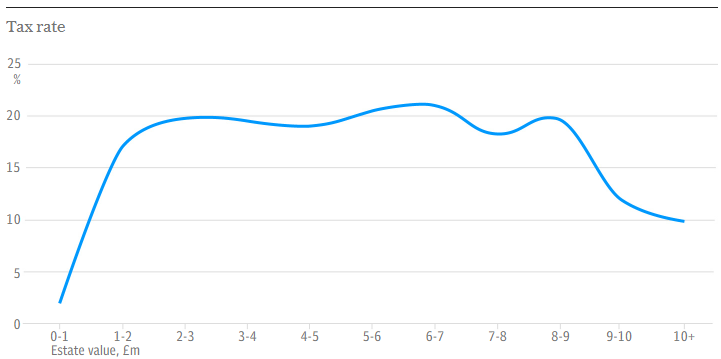

The redistribution argument for IHT might address the fact that it falls mainly on the homeowning, southern middle class. It is the reduced rates on eight-figure estates that creates the disquiet over trusts. On a more practical level, the proceeds disappear into the big pot of government income and cannot be traced thereafter. The tax is collected whether or not rebalancing opportunity is a political priority.

The opponents of IHT ignore that assets pass freely between spouses and civil partners. Housing value and pension assets accumulate without charge throughout a lifetime, and there are means of addressing where tax may arise on death.

The issue appears to be that an ageing population feels entitled to sit in a house, long since vacated by family, until their death and then expects it to be sold without charge on their children. This is a modern problem, as only one third of people owned a home a century ago. Home ownership in the UK peaked 20 years ago, and there is the possibility that bequeathing housing assets is already in decline as a political concern.

If offspring live in a house, then ownership may be transferred well before death. If they don’t, then they aren’t selling a primary residence and everyone pays tax on second homes. Inheriting a house isn’t winning the lottery.

Rags to Riches and Rags Again

IHT raises little compared to the big three of income tax, national insurance and VAT. For 2022/3 it contributed £7.1 billion and is hidden in the £46 billion of capital taxes in the chart below.

Fewer than 4% of deaths result in the tax. While more than one person is impacted by each incidence of IHT, it’s hard to argue there is general suffering on a scale requiring intervention. Making IHT an election issue is good politics if it rallies the base, but does not lead to much. The Conservatives readily horse-traded their 2009 commitment to a £1 million allowance in the ensuing coalition government.

Rising inflation and an unchanged exemption allowance since 2009 raise the number of estates that will be charged, but inflation increases a number of taxes. Duty is paid only on values above the allowance and an additional housing element was introduced in 2015.

IHT is a heavy tax if you are subject to it, but you are already among the more fortunate members of society. As a result, no one arriving in government facing budgetary constraints cares much for you once you’ve voted.

A final though is that IHT is irrelevant. “Shirtsleeves to shirtsleeves in three generations” is an American refrain with precise equivalents in cultures as diverse as the UK and China. The Williams Group, a wealth consultancy, studied 3,200 families and found that of every ten, seven lost the money after one generation and nine after two. That study lasted 20 years, presumably leaving time for the tenth family to fritter away its fortune.

If people are going to lose an inheritance, which is a form of redistribution, then it barely matters whether we tax it at source or not.

Tax Avoidance Is Not Tax Dodging

If you want to emigrate to avoid IHT, China, Russia and India impose no such tax. Australia, New Zealand, Canada and some Scandinavian countries have abolished succession taxes, but can have high rates of others. One of the best places to go is the United States.

There are federal death duties, estates are taxed in 12 states and six raise tax on beneficiaries, but the minimum threshold is high. The personal exemption is $11.18 million and it is estimated only 0.2% of estates will pay the tax.

In the UK, and specifically in England and Wales, your choice is to gift the money during life or on death. The longer you hang onto it, the harder it is to avoid IHT, but if you don’t trust your family then maybe you worry less about providing for them. If you die without a will or descendants, the government takes it all.

A Will

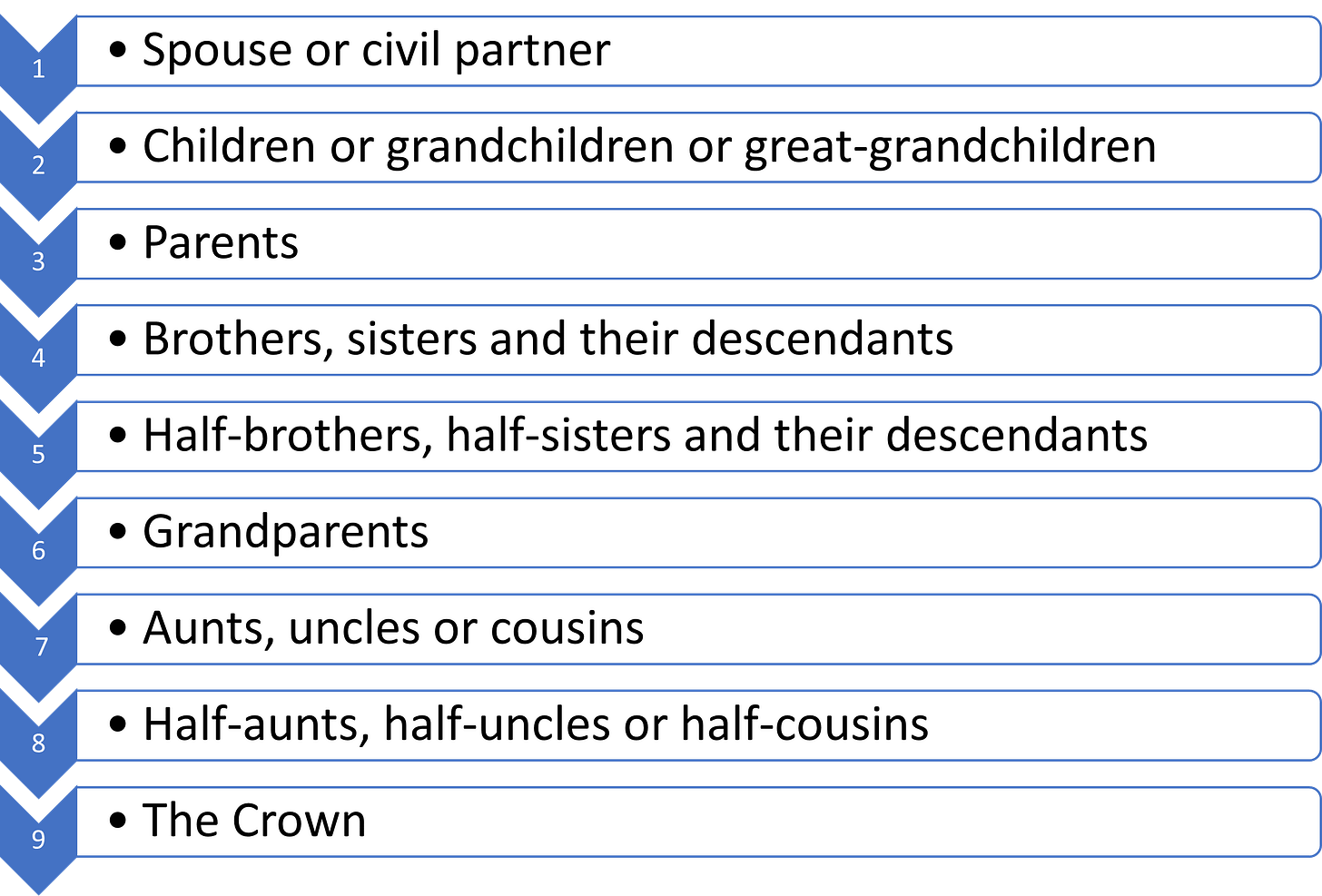

The two must-haves for planning are a will and a lasting power of attorney (LPOA). A will can be challenged or forged, but if you avoid great wealth and fiddling with the details just before your death, you should also avoid these outcomes. If you do not leave a will then your assets will be distributed in the following order of priority:

Without a will, your spouse or partner receives £270,000 and splits the rest with their children, or grandchildren if the children have died. If there is no spouse then the estate is split between the children or their descendants, or your parents, and so on down the chain.

A partner is someone to whom you have made a contractual commitment, rather than a relationship based on length of time. This means you need a will to bequeath to anyone other than a formal partner, including siblings or other family members you live with. The rights of brothers and sisters to inherit tax-free from each other was rejected in 2006 by a case that went all the way to the European Court of Human Rights. Overturning it is not high on the list of Brexit must-haves.

A Lasting Power of Attorney

There are two types of LPOA, one covering your health and welfare and another for financial affairs, including property. The “lasting” part covers mental incapacity, but otherwise you remain in control of your affairs. Anyone over 18 may be your attorney, but they must not be bankrupt if handling financial affairs.

An LPOA does not override a will and the main benefit is to have your affairs managed by someone you trust, when you are no longer capable or willing. There can be more than one attorney and in this case they have to agree on a course of action.

Avoiding Inheritance Tax

Very few estates in the UK are subject to inheritance tax. All wealth bequeathed to a spouse or civil partner is exempt tax. Your allowances also pass to them.

The tax-free allowance is £325,000, unchanged since 2009, while from 2015 an additional allowance of £175,000 exists for family homes. The first allowance is called the nil rate band (NRB) and the housing allowance is the residence nil rate band (RNRB). It may be used to give one house to direct descendants.

While your NRB is always available for you or your spouse, the housing allowance depends on the value of your whole estate, not just the property. The housing allowance withers away over £2 million, and is gone after £2.35 million, or £2.7 million including both partners’ RNRB.

Exempt Estates

Low value estates are excluded from inheritance tax provided they meet a few conditions around assets in trust, and that the gifts that were given in life by the deceased are genuine and properly documented. The conditions exist to stop assets being gifted or put in trust to make the residual estate appear small.

Low value includes estates of up to £1 million, before deductions for debts and transfers to spouses and partners. After deductions, the estate must be worth less than the Inheritance Tax Threshold of £325,000. Only couples who were always domiciled in the UK qualify for this exemption.

Cash and securities in the UK worth no more than £150,000 are exempt, provided the deceased was never a UK taxpayer.

There is also a Blue Light Exemption for military personnel who die due to injuries or disease sustained while on active service. This was extended in 2015 to emergency services personnel and covers care workers who died due to Covid 19.

Gifts

Gifts of up to £3,000 in total each year may be given to anyone at anytime. This amount may be carried over for a year. Married couples and civil partners may therefore gift up to £12,000 between them every two years.

Amounts over the allowance are added back to the value of the estate if given in the seven years before death. The rate at which they are added back is subject to taper relief, meaning an increasing share of the gift is allowable between years three and seven.

As gifts are usually spent by the receiver, it is a good idea not to gift large cash sums when death is predictable in the near future. The money is gone, but will still be added back to estate and taxed at 40%. Cash will have to come from the rest of the estate to pay the tax and if the gifts are very large, there will be a shortfall.

The gift must also be genuine. For example, if you gave your house away and continued to live in it, the gift is ignored when calculating the estate value and you are disqualified from low value exemptions. Equally, if you sell assets for under the fair value, such as a £1 million house sold for half that amount, then the difference is added back to the estate no matter when the sale happened.

You may give a one-off gift of up to £5,000 for a child for their wedding or civil partnership. More distant direct relatives and spouses-to-be may receive £2,500 and anyone else up to £1,000. You may hand out as many gifts of up to £250 to different people as you can find.

You may also give regular gifts out of income without restrictions, but will need to show that you had enough surplus income and your standard of living was not impacted by giving them. Provided you are confident of meeting these rules and have a surplus, regular gifting to relatives without depleting the value of your assets is one of the best ways of sharing wealth while you are alive.

Tax Efficient Investing

As befits Napoleon’s nation of shopkeepers, UK family businesses are shielded from inheritance tax. This extends to agricultural land, which has a whole sub-category of exemptions. Note that woodland must be cut at least every ten years, which prevents your carbon sink qualifying.

Business Relief rules exempt certain types of savings accounts and investment products from inheritance tax. Relief is for either half or full value. Full relief is available on a business or part of a business and shares in an unlisted company.

Half relief is available if you own a majority of the voting rights of a listed company, and on property, buildings and machinery owned by the deceased or in trust and used in their business. The deceased must have owned the business or asset for at least two years before death, to ensure the business is genuine.

Relief is not available for investment and property companies, charities, or where the business is being sold for cash or wound up.

AIM High and Low

From 1996, Business Relief was extended to include certain shares listed on the UK second market, known as AIM. This provides a tax benefit to investing here, rather than recommended tax planning. Listing rules are looser for these firms and their share prices are typically more volatile than larger companies.

Your investment should be held throughout your life. After two years, you may gift it to someone who will retain the tax free status as long as they continue to own the shares. Should they sell, the proceeds become part of their estate.

Since 2013, you have been able to hold AIM shares in an Individual Savings Account (ISA) allowing you to gain the relief from that vehicle and pass it on free of inheritance tax when you die. This is relevant when you are bequeathing these assets to someone other than a spouse or partner, who would get them tax free as part of your estate.

Wealth managers specialise in funds invested in qualifying companies and will mostly stick to better known and profitable businesses on the exchange. That said, if the law changes your benefits would disappear and you’d likely join a rush of people cramming through a narrow exit.

Trusts

Trusts are expensive to setup and run, and suitable only if you have large sums to bequeath. There are several types and these are the main ones.

Discretionary trusts are where you retain control of the assets, but do not benefit from them. If you die within seven years of putting assets into them, those assets are subject to tax. You also pay 20% when you gift assets of more than £325,000, plus 10-yearly and exit charges. Basically, you may put £325,000 tax free into a discretionary trust every seven years, but they are not worth the cost for that amount of money.

Immediate Post Death Interest Trusts are established to provide income for the surviving spouse and become part of their estate. These avoid the ten year anniversary charges and work best for your trophy husband or wife.

A Discounted Gift Trust allows you to bequeath an asset while retaining the income from it for your own spending. You must spend it all to keep it free of IHT.

Taxation of Trusts

Trusts pay income tax on their assets, except for bare trusts where the beneficiary pays. These trusts are frequently used by grandparents to pay school fees, allowing the grandchildren’s tax allowances to be used. This does not work if the parents fund the trust.

Trusts have a half allowance for capital gains tax, except for bare trusts which again use the beneficiaries’ allowances.

You might choose to use a trust to set up a life assurance scheme that pays out an amount on your death to cover the inheritance tax on your estate. This is a good wheeze, but does require you to make the payments while alive. Hence, unless you are covering a potentially very large bill, the insurance payments would just as well be a gift out of income.

Charities and the Mega Rich

If you bequeath at least 10% of your estate to charity, then tax may be payable at 36% on the whole estate. In your will you can gift a percentage of assets, or your successors may execute a deed of variation. This ensures the amount is no more than the minimum requirement, assuming your love of cats was not the primary motivation for the gift.

Family offices are a step-up from trusts and popular vehicles for hedge fund managers who have made enough money and can’t be bothered looking after other people’s assets any more.

The late Queen struck a deal for a £20 million exemption on the Queen Mother’s estate, estimated at around £50 million.

Inheritance tax is inconvenient, complicated by the further inconvenience of not knowing when you will die or whether to trust your family. There are ways to avoid all or part if it, but if you wait for the government to do you a favour, you’ll be waiting a long time.