Money - Dead Reckoning Part One

Cryptocurrencies are scams for money launderers and drug dealers. Why then are the US and China looking at them again? It's time to take The Sniff Test.

If you must own one asset for 100 years and can’t sell, what would it be? A house, gold or shares? What about bitcoin? Only one of those options is designed to hold its value.

It’s Barbie versus Oppenheimer weekend and the pink lady looks set to win the battle of the box office. Over half a million articles have been written about the film, thanks to more than 100 brand partnerships. Even Tom Cruise has had to accept second billing for the launch of the seventh Mission: Impossible film, Dead Reckoning Part One.

In this, Cruise’s team tackle an artificial intelligence that threatens the world after learning to think. The theme is topical as well as playing on our mortal fears. Alien and silicon beings are the stuff of nightmares, because they are aware and consequently fight to survive as a species. Pandas don’t care that their species might go extinct and would put more effort into breeding if they did.

Interest in Hollywood films is worldwide. Culture is one of many ways that countries project dominance because the biggest and richest nations have the resources for both military and soft power. Money allows the exercise of that power.

A challenge to the world order

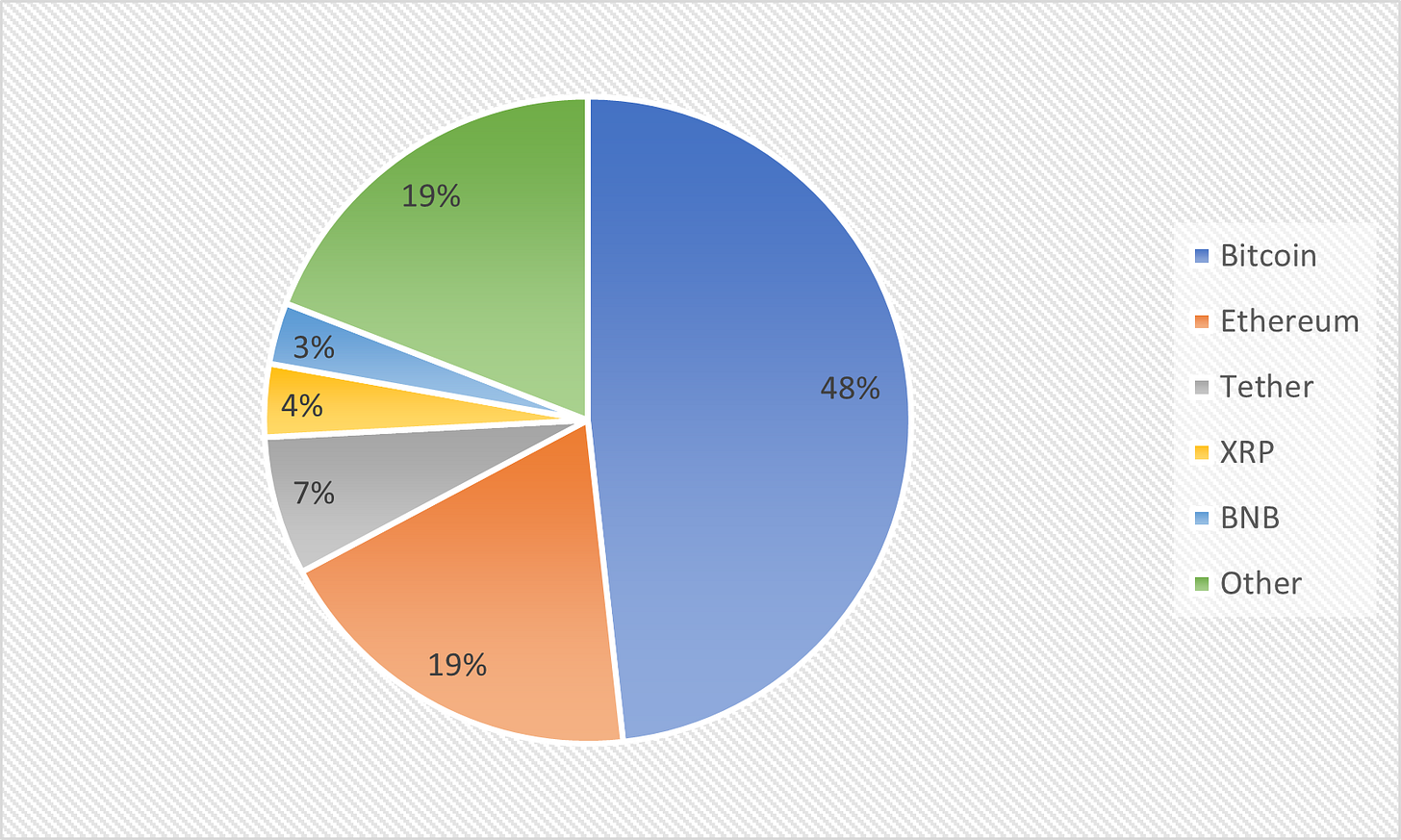

Cryptocurrencies are tiny. Their total value is $1.2 trillion and the fact we measure it in dollars says everything. Bitcoin and Ethereum are the two largest.

Commercial property is worth $30 trillion, the world’s stock markets total nearly $100 trillion and this is similar to the amount of money in circulation. Only $2 trillion of this is dollar notes and coins.

Yet cryptocurrencies challenge the order of things. In a face off against the US dollar they would be crushed, but many countries want to reduce their dependency on dollars and will sustain crypto as long as it is useful in that fight. The world is competing for dominance in artificial intelligence, even without Tom Cruise, but is engaged in a bigger battle for control of money.

Part Two will explain why digital currency transforms the world. But to set the scene we must first understand what money is and why it is the ultimate expression of power.

What is money?

Money is cash and bank deposits and in the UK is 96% electronic. Money serves three purposes, which are to allow us to buy things, allow us to compare the value of things, and allow us to save. In textbooks these are referred to as a means of exchange, a unit of account and a store of value.

Money is also how we pay our taxes, which turns out to be very important.

A brief history of money

Let’s say your cow is worth three of my sheep. I don’t want to carry either around to make payments and so when I buy your cow I owe you three sheep. It’s trickier if I want half a cow.

I give you a token to recognise what I owe you. Money represents a debt that may be cashed later. It is also a means of valuing your cow and my three sheep.

As our tokens increase in use through the village, they come to represent chickens and bread, horses and carts, and items of clothing. We hold onto our tokens to spend tomorrow and because we know what they mean in terms of cows, sheep and anything else we need.

The neighbouring village has its own tokens. When we trade our livestock for its fish, we need to establish an exchange rate between them. The two tokens circulate together for a while and gradually one of them proves to be more effective and both villages use it.

When the Romans invade we are compelled to use their currency. We have to pay them taxes and they only accept denari. Tax payments allow governments to control at least some of the money circulating in an economy.

As Rome is the greatest power in the known world, has the largest economy and is capable of buying the largest army, it makes sense to use its money. It’s accepted everywhere and holds its value against the goods and services we buy. The Romans are happy for us to use it because it’s easy to collect taxes in the same money throughout the empire.

Today five currencies account for 92% of the foreign exchange reserves held around the world. The dollar share is declining but remains dominant.

The Federal Reserve estimates six out of ten global bank deposits and loans are in dollars, and the European Central Bank says 40% of international trade is, which is four times what the US itself trades.

The US has an open financial system and is happy for the world to use dollars. The Chinese, by contrast, keep tighter control on the use of renminbi and will not rush to allow foreign banks to create it. Both China and the US worked to drive cryptocurrencies out of their economies in order to retain control over money. Both are now figuring out how to bring it back in a way that suits them.

The need for speed

Pounds and dollars allow us to pay for things because in the short term they hold their value. Recent inflation erodes that value faster than we are accustomed to, but money remains better than any alternative. You don’t want to pay for your daily bread with Apple shares or bitcoin when their value rises and falls in an unpredictable manner.

Money moves quickly, but at a cost. We can use our credit cards at any hour and the sums are small enough that finance companies agree to square up in the future. This creates settlement risk, which means one counterparty may not honour its share of the bargain, but the sums are small enough to manage.

Moving large sums is riskier and banks don’t want to be exposed. When you transfer a deposit on a house, the seller wants to see the money the same day. This is done through a different and faster payment system than the one used for credit cards, but it costs a lot more to use.

When you move money across country borders it is equally expensive and there are few worse starts to a holiday than being ripped off by the commission-free exchange booths at the airport.

There is an emerging alternative. $1 billion has been transferred for 3 cents and verified in a quarter of a second. Polygon Technology created the means to do this by building applications on Ethereum, which is the world’s largest blockchain ecosystem.

This matters because we don’t care how our money is moved, just as we don’t care who owns the communication channels on which we make calls and send emails. All we need is for it to be fast, cheap and available.

The 100 year investment

I am pretty sure your answer about the 100 year investment was not dollars under the bed. These have lost 97% of their purchasing power since 1900, which means that prices are 36 times higher. The pound lost over 99% of value in that time, making prices 157 times higher. The difference is the cost of losing an empire.

Meanwhile the price of gold in dollars is up over 100 times. After a ten-decade slumber you would discover far higher prices, but be able to buy three times more than when you fell asleep.

Then again, had you had trusted your investments to the US stock market you would have done 1,000 times better than gold. There is survivor bias in these numbers because companies go bust and we assume you keep backing winners. Two thirds of the largest companies in 1900 were railways and most no longer exist. Fortunately nowadays there are funds that keep you invested in the biggest surviving companies.

Some houses from 100 years ago still stand, while others have been replaced. The main issue comparing houses is changes in size. The best estimate is that prices have risen by less than shares and much more than gold.

The Supply of Money

The reason money is an appalling store of value is that there is much more of it than in the past. This doesn’t matter because we use money to buy investments that rise in value. What matters is that we are able to sell these investments for cash when we need to spend rather than save.

One measure of money is the size of the Federal Reserve’s balance sheet. While the US government controls money, this is exercised via the Fed, making it the apex predator of the world’s financial system. A shift to a digital dollar would put the Fed in direct control of money.

There has been a lot more money since the Global Financial Crisis in 2008-9. The first effect of this was massive inflation in the price of assets, but once governments started handing money directly to people during the pandemic, inflation spread to goods and services. It’s common knowledge that you raise interest rates to rein in money supply and hence inflation.

Except that higher interest rates mean more money is required to service the debts that have accumulated rapidly since 2008. The sums are so large that raising taxes would see the barbarians overrunning Rome very rapidly. An alternative is to use new money to pay the interest. There is a relationship building between the size of the Fed and the amounts required to service debts. These are projected forward 3 years to allow for the time it takes reprice loans.

The growth in money is why US shares have risen 19% this year, despite the common knowledge that shares go down when interest rates go up. You may have heard that this is all to do with AI and the Magnificent Seven large technology companies that account for all of the stock market’s rise. Have you also heard that Japanese stocks are up 26%, or that a basket of cryptocurrency miners has tripled, thereby trouncing a similar basket of AI names? Despite Tom Cruise’s best efforts it’s not all about AI.

You can draw a chart to show almost anything you want. Here’s one that shows that the price of Ethereum, the token supporting the blockchain mentioned earlier, correlates with the rise and fall in the amount of money the Fed provides. This has a few people excited that blockchain tokens may be the best way to preserve value for the future.

A more dramatic conclusion is that the price of everything is being driven by the size of the Fed. The difference between the speed at which various prices change is down to risk.

Houses are useful to live in as well as rising in value and hence pretty safe. Shares in companies are riskier because firms fail, but the stock market as a whole is more reliable. Cryptocurrencies are very risky and their prices will be volatile, making them useless as a means of paying for things. But some are designed to be stores of value over the long term and the more the money supply rises, the more they will rise in dollar terms.

The Supply of Bitcoin

The maximum supply of bitcoin is fixed at 21 million, a level that should be reached around 2140. To date 19.4 million coins have been mined, including an estimated 4 million that have been irretrievably lost. This means that supply will rise extremely slowly from here.

One bitcoin is divided into 100 million satoshis. This does not effect its value, but is designed to make it practical to keep using bitcoin when its dollar value is astronomical.

We should call bitcoin a crypto asset, not a currency. It may never be a good way to buy everyday items and it needs a technological overhaul to be cheap and fast enough for money transfers. This includes addressing the vast amounts of energy required to validate its blockchain.

The risks of bitcoin as an investment are that it can be irretrievably lost and it remains reliant on the goodwill of governments to be cashed in for currency to pay taxes. These risks reduce significantly as governments find ways to control bitcoin as an investment. We will look at this next week.

It is possible that bitcoin could be the apex predator on top of an alternative monetary system designed to retain value over decades. Plenty of people have an interest in that happening.

An Exorbitant Privilege

Governments can make it difficult to own any asset, be it blood diamonds, stolen art or bitcoin. You can own them, but if they’re banned you’ll need to launder them through an amenable regime and then pay to switch that regime’s currency into dollars.

That exchange is going to go through the New York banking system. This allows the US to sanction Russia and North Korea given both countries rely on the dollar. It is also why banks from all countries pay huge fines in the US when accused of wrongdoing, because to risk losing access to dollars is to flirt with death.

A French finance minister called the dominance of the dollar an exorbitant privilege. It is the way the US exercises power. The Ukraine conflict suggests that economic warfare is now a higher priority and a preferred option to a military presence. If it’s war, then expect the other side to fight back.

New technology including AI and blockchains will be central to that fight. After all, an AI at war with humanity would use money that humanity didn’t control. AI would use bitcoin.